There Is No Debt Or Deficit "Problem"Short Takes: Tax CEO Pay; Overwhelming Support For $15-an-hour Minimum Wage Hike; Uber Bends A Bit

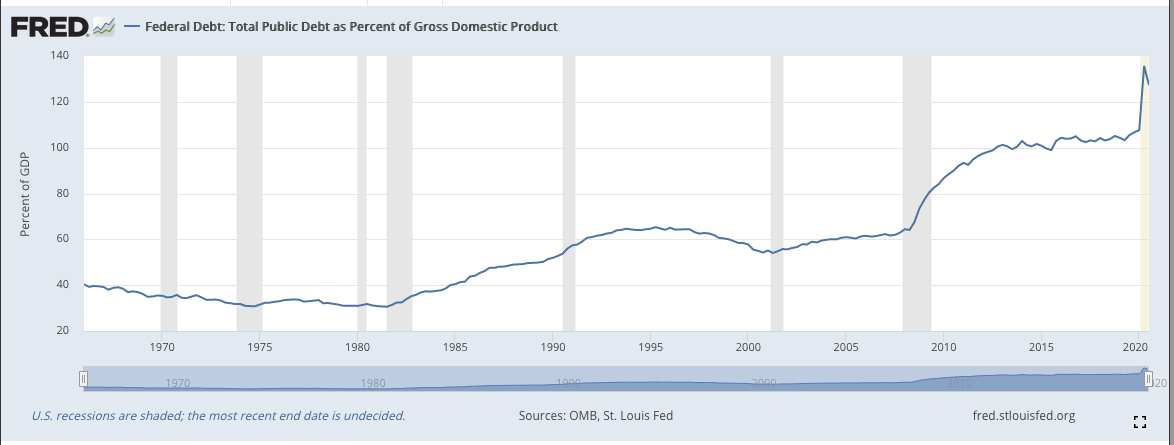

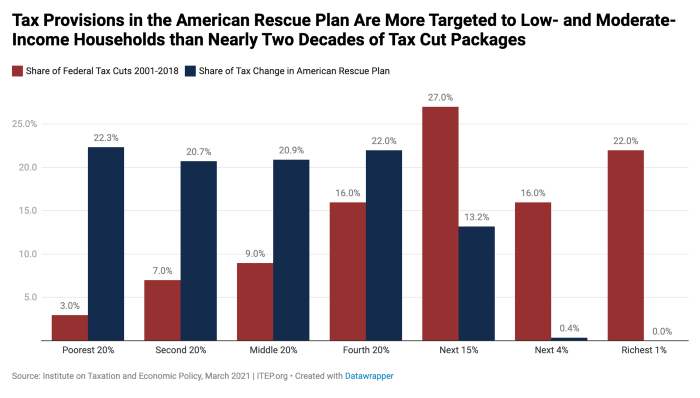

LONG TAKEIt’s those zombie voices again. The ones who rise up from the dead, or from a policy corner, to start the drumbeat of fear about “debt” and “deficits”, all in order to block progress for the people. So top-line idea for this week: there is no debt or deficit crisis. The U.S. has never had a debt or deficit crisis. We have plenty of money in the richest nation in human history. We should spend more right now, not less. This is nothing new—I wrote a whole book long ago about the phony debt crisis with the subtle title, “It’s Not Raining, We’re Getting Peed On” (which by the way you can download the 2013 updated version for free here—the basic arguments and evidence are still relevant today, alas). The idea that there is no debt crisis is important to spread to everyone right now because even folks who are all in favor of progressive policies get rattled by the chorus of “we should balance the government budget just like we do with our own checkbooks.” But, to start off, that’s nonsense. The U.S. Treasury can print money—plenty of it—and the Federal Reserve creates money through various tools it has. That’s why it’s really dumb when you hear talking heads or political fools warn that the U.S. will end up bankrupt like another Third World country—other countries do not have a currency that is the global standard and, Chicken Little warnings to the contrary, that isn’t changing anytime soon. The point is that the your-checkbook-is-like-the-U.S Treasury analogy is bullshit and it’s just rhetoric to confuse people. Next point. Any taking on of debt—by an individual or a person—raises the important question: are we taking on debt for the right reason? If you take on debt so you can go gamble in Las Vegas, well, that might not be a good strategy. But if you take on debt to, say, put a kid through college, that’s a good use of debt (yes, college should be tuition-free...) Same is true with the government. Spending trillions of dollars now to support people in the greatest health crisis and economic collapse in a century has been a great use of money—it likely saved millions of people from going hungry and kept some of the economy from imploding (I want to hammer my point over these many months: not enough was done—people should be getting $2,000 per month in this crisis, among other steps). And, now moving forward, we should spend trillions of dollars more fixing the country’s infrastructure, and taking on climate change at the same time, because that is a very, very good use of lots of money, and a good reason to take on debt, as a nation. A quick pause to make two definitions clear because sometimes they are muddled together, especially by dumb-ass politicians: When we speak about government fiscal deficits, we mean the shortfalls in the annual budget of the government in a given year. The overall debt is the accumulated deficits over many years. So, to make this clearer—you might have a huge one-year budget deficit that is barely a blip in the total long-term debt over a period of, say, 20 or 30 years. Some context: In 1946, the country’s debt-to-gross domestic product ratio was 108.6 percent—we use the debt-to-GDP measurement because it makes sense, right...it’s a way of comparing the debt relative to how much economic activity there is. Look at this chart by the Federal Reserve Board showing the debt-to-gross domestic product ratio from the 1960s to now. The chart tells us a few things. The debt level after WWII was greater than, say, the debt level in 2010 as the country was dealing with the Great Financial Crisis Depression (it’s wrong to refer to what happened in 2009 as a “recession” when it destroyed millions of peoples’ livelihoods and savings), when it stood at just 87 percent. In other words, the adults living right after World War II were handed the greatest debt the country had ever had, more than a debt assumed in the huge 2009-2010 financial crisis, but that post-WWII generation experienced the greatest prosperity in the country’s history. Why was that? Yes, a big part of the leftover debt was financing World War II. But, the money in that year and years to come was used for things like the GI Bill—to allow millions of veterans to go to school—and building infrastructure (the inter-state highway system was an Eisenhower-era project financed with government debt). Stuff that helped people. Now, to today: In the third quarter of 2020—in the middle of the once-in-a-century pandemic and economic collapse—the debt-to-GDP ratio rose to 137 percent. And that was smart: we kept millions of people from going bankrupt and hungry. And that debt-to-GDP ratio will no doubt get higher this year with the passage of the $1.9 trillion relief bill. Good! But, we should not stop there. Spend more, now, with interest rates at rock bottom lows. Rebuild the roads, bridges, highways and other systems with 100 percent climate change-friendly projects. That will be money well-spent to get people back to work, and save the planet—and, by the way, it will over 20 to 30 years support economic prosperity because people will have jobs. Now, if someones wants to wring their hands about today’s bigger government deficits or the larger long-term debt, don’t give them any opening to point fingers at those people who want to spend money on the people, and don’t allow those folks to use a non-existent debt “crisis” to slow down even a bit spending money to fix deep, structural problems. Point out those, instead, who prop up a corrupt system—because that’s really at heart the problem of where our money goes. Point a finger at those people who give huge tax cuts to rich people and corporations. Point a finger at the billionaires who refuse to pay their fair share in taxes. Look at this graph from my friends at the Institute for Taxation and Economic Policy: What do we know from this picture?

In other words, there’s your debt solution: for fuck’s sake, stop giving money to rich people and corporations, and demand the rich pay higher taxes. Point a finger at those who vote for endless wars and escalating budgets for the Pentagon—the Iraq and Afghanistan wars and post-9/11 military aggression have alone cost well over $6.4 trillion through 2020...and counting. Point a finger at those politicians who stand in the way of Medicare For All—because they pocket hug contributions from the corrupt health care and BIG Pharma industries—because Medicare for All would save the country, save the federal budget, trillions of dollars over the coming decades. Point a finger at the corrupt financial system which is a floating casino, a Ponzi scheme and Fool’s Gold paradise, patched together by lies, deceit and a healthy dose of massive public indoctrination of the wonders of the “free market…which then triggers one huge financial crisis after another that are staunched by our tax dollars. In sum, there are four easy ways to bring in more money to pay down some debt, if that’s someone’s concern:

But, don’t let the lie spread that we should sacrifice peoples’ needs on the altar of a non-existent “crisis”. I say roughly the same stuff today in my Working Life TV podcast episode, for those of you who like video (SUBSCRIBE TO THE CHANNEL TODAY!!!): SHORT TAKES

If you liked this post from Working Life Newsletter, why not share it? |