|

The Trillion-Dollar Saganesque Big Number Fog

SHORT TAKES: How To Use An Illegal Corporate Tax Break--And Keep the Money!; Recovering Stolen Wages; A West Virginia Op-Ed Targets Manchin; Digital Platform Organizing Thoughts

| Jonathan Tasini | Jun 4 |

LONG TAKE

Back when Carl Sagan was a thing, he was mocked (even by Johnny Carson though, if you are interested, here’s also an actually interesting, mostly serious, conversation between the two) for talking about the universe—stars, galaxies—using language that often depicted the scale of the universe using “billions and billions” as a yardstick for size or distance.

When Sagan told us, for example, that the center of our galaxy, the Milky Way, was 40,000 light years away, well, it was appropriate to gasp because we could not truly comprehend in the human experience how to traverse that distance. It was too big. Knowing the granular details for comparison sake—how far a light year is, for example, compared to traveling to visit grandma on the other side of the country—wasn’t important. So, we simply filed that away as “it would not be possible, in the span of human existence, to make that journey, so I’m just going to accept the enormity of the number in awe and without question”.

The problem is that the Saganesque approach is replicated, on a daily basis, by politicians and lazy journalists when it comes to talking about the economy, and, specifically, about the government budget. That has been true, and frustrating, for a very long time—and it leads to crazy, stupid headlines in the spirit of “Social Security is going broke!”, “Public pensions are bankrupting us so let’s cut benefits!”, “Deficits are too big!”, “The debt is going to sink the country!”, “Inflation is roaring back!”.

It’s a product of the superficiality of the debate, the fact that most journalists who write about economics, budgets and money are fairly shallow (meaning, they don’t read and, instead, traffic in gossip and quote-repetition) and politicians… well, you know, most of them are just deeply disappointing (I need to be kind sometimes with my descriptions, right?).

We are seeing this play out every day in the foolish debate about spending plans proposed by the Biden Administration—and, frankly, the president is undermining his own case (with the able compliance of the always-unimpressive Chuck Schumer), and, ultimately, hurting millions of people, by falling into the same trap.

YOU HAVE TO GIVE RELEVANT, MEANINGFUL CONTEXT TO THE NUMBERS.

Here’s what I mean.

The two big proposed bills—the American Families Plan and the American Jobs Plan—had a beginning projected cost, respectively, of $1.8 trillion and $2.3 trillion in new spending (in other words, spending *above* the baseline spending already in the federal budget for various projects like highways). Any person hearing the phrase “trillions of dollars” is pretty impressed or, more likely, overwhelmed—that’s a lot of money, even making Everett Dirksen look like he was rhetorically playing with tiny numbers.

The “wow” factor gets even more sexy when you read the tick-tock media reporting about the back-and-forth between the political parties about the two bills. It’s basically all big total numbers—NEWS ALERT: Biden cuts $500 billion from his infrastructure plan! (aside: a really weak idea since he was, at that point, negotiating against himself). NEWS ALERT: Republicans say, “Not enough because it’s too expensive, how about $800 billion!” Back and forth they go.

What you virtually never read is CONTEXT, CONTEXT, CONTEXT: putting aside the *policy goals* and the *political debate about the need* say, to rebuild a pathetic infrastructure that has a C- grade from the American Society of Civil Engineers (you can actually check the grade for your state here), what do those numbers represent in the total economy? In an economy that is roughly $21 trillion in size—and will reach $32 trillion by 2030—what do the numbers proposed represent, as a share of the economy. Or, as important, if we are going to spend X amount per year on child care or paid leave or roads or climate change efforts, how does that expenditure compare to what is spent on, say, the Pentagon, (which wastes monumental amounts of money with barely a peep from Congress)

For example, when Biden cut his proposal, as Dean Baker points out:

Biden’s latest proposal is a bit less than 0.8 percent of GDP. It is just over a quarter of what the Pentagon is projected to spend over this period. On a per person basis, it comes to around $640 a year.

So, what the debate needs is the context of a plan relative to the size of the entire economy AND the context relative to what is spent elsewhere—the latter, of course, introduces, at the very least, value judgements about the worth of a dollar spent on a road versus a nuclear bomb. And individuals can make their own judgements about priorities—but they really can’t make informed judgements without context.

This problem is not a new one and has hobbled the country for a very long time. I asked Dean via email:

So, Dean, the lack of context and perspective on numbers is maddening in the current big proposals on infrastructure and other critical initiatives but this is very much the same void we get in your favorite subject, Social Security, as well as public pensions, right? Meaning, there’s never a context given for the long-term funding horizon and the ability to pay significant levels of benefits no matter what happens, which, then, leads to the sky is falling and calls for entitlement “reform”

Dean: There is enormous confusion about where the government’s money is going and the media bears a huge amount of responsibility for this. When they print numbers in millions, billions, or trillions, no one has any idea of what these numbers mean and EVERY reporter knows this fact. The result is that people hear huge numbers and get scared by them, having no idea whether they are actually big or small relative to the size of the budget or the economy.

In the case of Social Security, the program is projected to face a shortfall in a bit less than 15 years, but we could easily make up the shortfall without a major hit to the budget or the economy. The same is true for most of the pension shortfalls facing state and local governments.

It really is inexcusable that budget reporters don’t feel a need to put their numbers in context. Dishwashers in restaurants and custodians in office buildings have to work for their paychecks, why don’t budget reporters?

To state the obvious: When you inject context into a debate, then, the frame of a debate can shift pretty dramatically. And context prevents, or at least can counter, the pervasive mendacity pouring from the mouths of politicians like Fifth Columnist Joe Manchin. Imagine if vast numbers of voters were regularly told, no, the level being proposed to raise corporate taxes is quite modest compared to profits or compared to the rest of the world… or the amount being proposed to fund child care is miniscule compared to the Pentagon’s budget just for the over-budget advanced fighter jet program. This is among the many reasons Schumer is a horrendous leader of the Democrats in the Senate: he drones on and on, spending his TV time skewering Republicans rather than using his time to provide context to the people watching; he’d rather score points in the little inside-the-Beltway power struggle rather than shift the understanding of what these numbers mean (of course, to really educate the public Schumer would have to go hard against the corporate interests and moneyed elites who refuse to cough up a fair share in taxes and are trying to defeat the bills—and those folks are big donors to the Democratic Party).

The last point is how bad this is politically—something I’m going to plumb more soon in ruminations about the weak state of the Democratic Party. News flash: people do not care about “bi-partisanship”, which is a deadly confection created to substitute for informed knowledge. They have no idea who Joe Fucking Manchin is. People want whatever happens to make a difference in their pocket books and paychecks and communities—and “bi-partisanship” actually has the opposite result because it shrinks the scale of what must be done.

Prediction: a “bi-partisan” deal, or a shriveled jobs or infrastructure plan served up to please Manchin or Kyrsten Sinema will guarantee defeat for Democrats in 2022 and probably 2024 (I would donate to a competent progressive primary challenge to Sinema when she is up for re-election in 2024). Standing firm and passing bold plans will mean you win in 2022 and 2024—if the voters are given context on how the dollar numbers will translate into making their lives better, and are a damn good, cheap use of money.

SHORT TAKES:

Each day, I think: nah, corporations can’t make up yet another scam to rip us off. And, nope, I’m wrong every time. To wit: I give you the tax version of the football strategy of running out the clock…

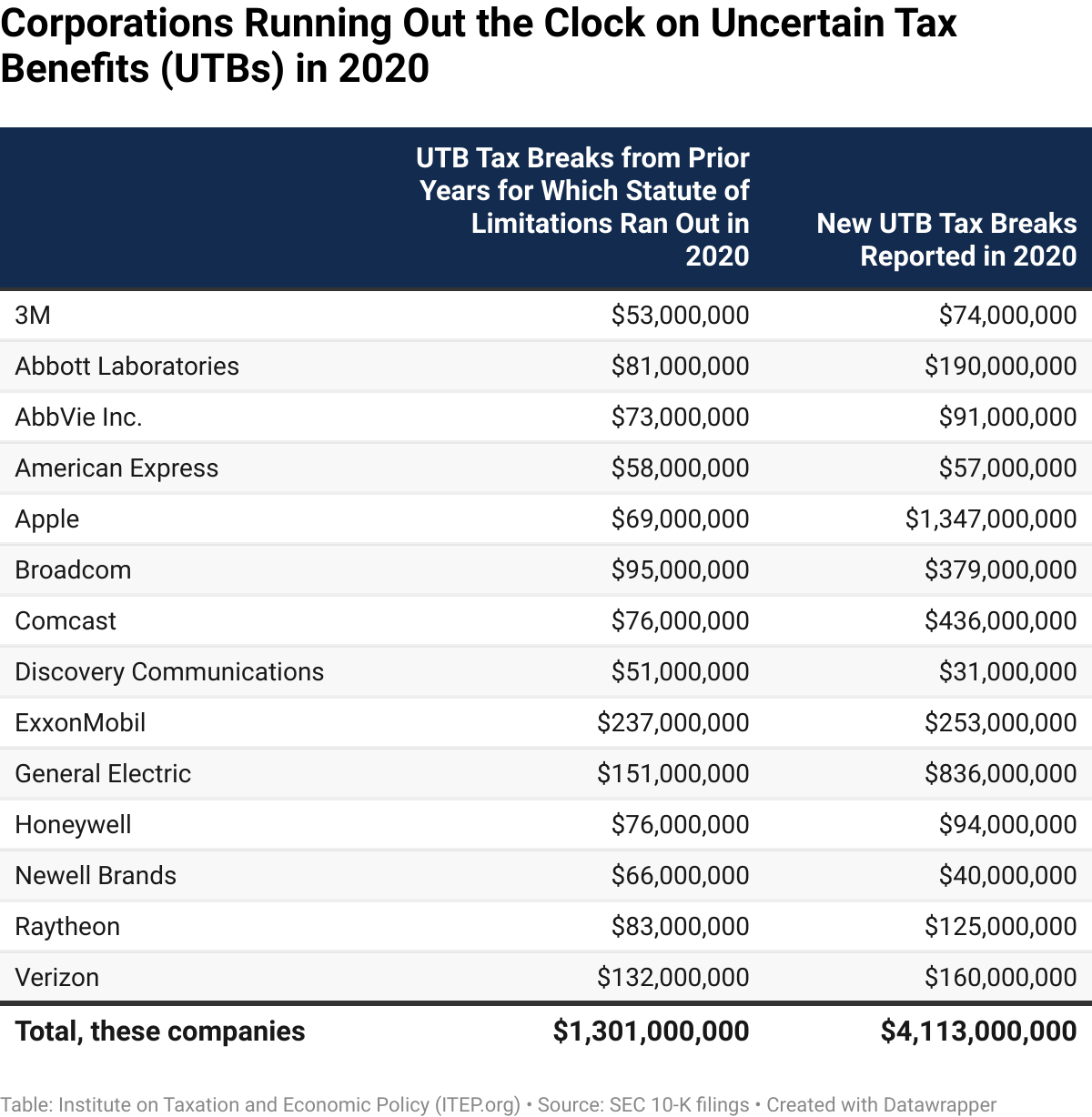

As our friends at the Institute for Taxation and Economic Policy explain:

Each year, corporations publicly state that some of the tax breaks they claim are unlikely to withstand scrutiny from tax authorities. And each year, corporations report that they will keep some of the dubious tax breaks they declared in previous years simply because the statute of limitations ran out before tax authorities made any conclusions.

Meaning—the corporate tax manipulators know what they are trying to do is against the law…but they also know they can outmaneuver the IRS.

How’s that?

For more than a decade, tax law has required publicly traded corporations to publicly report “uncertain tax benefits” (UTBs), defined as tax breaks that authorities are likely to disallow. Companies report UTBs on the 10-k they submit to the Securities and Exchange Commission and make public.

Publicly traded corporations also report when they definitively keep these tax breaks. Sometimes this happens because tax authorities approve them or settle with the companies to avoid longer litigation.

The problem is that corporations often report that they keep these tax breaks even when they are not approved by tax authorities because the statute of limitations ran out, which can happen in three years. [emphasis added]

Here’s ITEP’s table on this scam—

This is a consequence of the annual, gradual defunding of the IRS—which means that the agency goes into battle with too few agents to fight legions of highly paid corporate lawyers and accountants who are armed with the equivalent of tax-avoiding nukes…which often just boils down to deluging the IRS with mountains of paper containing complex financial and corporate structures that require lots of time to dissect—thus, the running out of the clock.

Wage theft happens every single day. Companies steal workers wages through a whole set of scams usually made possible by threats, fear or lack of information—individuals are afraid to report their employers for withholding pay (especially true of undocumented workers—another reason to give folks legal status), bosses just do not pay legally mandated overtime and some workers just find keeping track of what should rightfully be in a paycheck.

This is why who runs the Department of Labor (DOL) makes a difference—a point I hope my progressive friends keep in mind whenever they are inclined to say, “there’s no difference between the parties”; there’s a legitimate critique of the Democratic Party (one I regularly take part in) but it’s worth doing so in a more complex fashion, recognizing that for lots of people who is in charge can mean real dollars and cents, either lost or gained.

Example: just a few weeks ago, the DOL’s Wage and House Division recovered recovered $3,852,968 in back wages for 1,100 employees from an oil and gas inspection company, FIS Holdings LLC of Sand Springs, which the division found had violated overtime requirements. That’s real money for people.

From the Division’s release:

Investigators discovered that the company, which does business as Frontier Integrity Solutions Operations LLC, paid workers a fixed amount per day, regardless of the number of hours that they worked. This practice resulted in violations when employees worked more than 40 hours in a workweek, but the employer failed to track those hours or pay workers overtime. The employees, in 40 states nationwide, typically worked between 50 and 60 hours per week. The employer’s failure to keep records of the number of hours employees worked also resulted in recordkeeping violations.

Think about this: this company, with workers in 80 percent of the states, is a no-name company. I never heard of it. And, then, just imagine logically how often this happens, in every state, in every industry, in the hundreds and thousands of no-name companies who skate under the radar—and how that robs people of hard-earned money.

When a “love letter” has an obvious target—even if he’s unnamed… This made me chuckle—clearly when someone writes an op-ed in the current environment in a West Virginia newspaper entitled “WV delegation should support tax on wealthy” we all know who this is about: Fifth Columnist Joe Manchin, who really doesn’t give a fuck about people in West Virginia unless a person is among his corporate donors. As this piece points out, West Virginia may be the most in need of the whole raft of robust spending outlines in the Administration’s plans—plans Manchin is trying to block or whittle down. He really is the most corrupt corporate Democrat in the U.S. Senate. Take this column and spread it around.

Organizing people who work on digital platforms has its own challenges—not the least of which is that connecting to people with face-to-face engagement is pretty much not an option on a mass scale. Here’s something worth reading about the nature of working on digital platforms and, then, organizing digital platform workers, with a mostly European context—but still useful.

If you liked this post from Working Life Newsletter, why not share it?