|

Here's Why Our Pay Is Too Low

SHORT TAKES: Bankers Declare "Incest Is Best"; Slavery Is All Good In The Name of Money; Inheritance Scams; Chart of The Day--Unequal COVID Wealth Growth

| Jonathan Tasini | Jan 6 |

(A question [which, if this quite weak platform had the capability to post a poll, I’d do a poll, sorry!]: I’m considering the option to ask people to support the labor involved in putting the newsletter together (it takes time!) at a very modest subscription level, say, $5-per -month/$50-per-year. If you would consider it, post in COMMENTS, along with “I’d really like to see more of X in the newsletter or here is what is missing to include, now and again…”)

LONG TAKE

One of the hardest things in life is to have the time, and head space with everything else swirling around in daily life, to link together one piece of information or a slogan— say, “inflation is up”—with a whole series of other pieces of information that create a picture of reality, and, through that linking of information, come up with an explanation for the actual cause of the piece of information in question— for example, “why is inflation really up?”—rather than superficial nonsense (spouted from the likes of Joe Manchin, who knows very little about how the economy works). That’s why it’s so easy, with the help of social media, for the propagandists and frauds to mislead people—most people just don’t have the time to assemble a deep set of credible information to comb through.

Politicians and “journalists” (I often refer to “journalists” as “transcribers of press releases”), intentionally and unintentionally, make this challenge even greater by throwing around slogans that are usually filled with ideological assumptions and often bare little resemblance to the truth.

It’s intentional, say, in the case of someone like Ted Cruz or NYT columnist Tom Friedman because of a combination of a desire to lie for political gain and/or an elitist ideology that reveres the “free market”.

It’s unintentional on the part of most people because they either don’t read and traffic in gossip and/or it just fits with their general way of looking at the world, which is a product of superficial Economics 101 classes or, more simply, living a life that seems to match the slogans.

So-called “free trade” is my favorite example— “free trade” does not exist. Period. It likely never did exist (at least as conjured up by the 19th Century economist David Ricardo) and, certainly, does not exist today in a world of monopoly power and at a time when capital moves in the blink of an eye across oceans (making a mockery of the conditions Ricardo outlined in his comparative advantage theory of trade).

Read any so-called “free trade” agreement (I have, alas, wasted many an hour doing so) and what you find actually is the opposite of “free trade”. True “free trade” regimes could be written on one page—drop all tariffs, such a deal would say. Instead, modern trade deals are hundreds of pages of complex, detailed, intricate rules to protect corporate rights, especially corporate ownership of patents and intellectual property.

But, “free trade” is a very clever marketing phrase—everyone likes free stuff and who doesn’t like to trade. And it’s a useful way to smear people—if you are not for “free trade”, then, you are painted as backwards, fearful of the future, blah, blah, blah…

There is a point to this windup: using trade, I want to show you a trail of links that explains pretty much a central reason why peoples’ wages are too low.

Last month, as the year drew to a close, the Maquila Solidarity Network (MSN), a labor and women’s rights organization based in Toronto, Canada, released a report about the state of collective bargaining in Mexico. The point of the report was to track whether Mexican labor law had changed much to protect workers—which was a selling point for the original North American Free Trade Agreement (which took effect in 1994) and the re-negotiated NAFTA 2.0 (officially known as the United States-Mexico-Canada Agreement, or USMCA) that took effect July 2020. The MSN report got, to my knowledge, somewhere between zero and no discussion on cable news or in the august pages of The New York Times and its ilk.

Before I explain a few key details on the report, let’s backfill the story a bit with some context:

Every trade agreement—EVERY. SINGLE. ONE—has always had one main goal: writing down rules that give corporations even more power to roam around the world, looking for the cheapest wage possible. Corporate CEOs can still do pretty much whatever they please when it comes to exploiting people in every corner of the planet; it’s just that trade deals make everything easier.

Simplified, the dynamic goes something like this, and it’s a circular feedback loop—

Companies threaten to close plants and move overseas unless workers accept lower wages, and, though it’s illegal to do so, CEOs make such veiled threats during union organizing campaigns;

Slave-like wages paid to millions of workers across the globe is the entire rationale behind “supply chains”. Back in October, I suggested that we don’t just nod when hearing the phrase “supply chain problems”. Supply chains is a dry phrase that hides the truth— a vast system of factories dotted in all corners of the planet that turn out stuff mostly made by people who are paid below a basic survival level (see below in SHORT TAKES the Intel-IOC charade).

Slave-like wages ripple back across the supply chains to here. You hear it every day: costs have to be “competitive” with the “global marketplace”, yada, yada, yada… Those costs, of course, never mean lower CEO pay—just low wages for the people who actually make companies run. My definition of “low wages”, by the way, is straightforward: people can’t pay their monthly basic bills, people live off credit cards, they don’t have any reserves for emergencies, and they sink deeper into debt.

Consumerism feeds this loop, at the low-cost end. People living on low wages are forced to find the lowest-cost item—which sends them to Wal-Mart.

Wal-Mart is that poverty-level driver model: Wal-Mart does huge business in China and, then, turns around and ships good back here to be sold by its poverty-paid workforce to people who are too poor to shop anywhere but Wal-Mart.

Look, as I said above, the above explains “in the main” why wages are too low. The U.S. has other—how can I phrase this?— “peculiarities” in the low-wage, exploitation paradigm, including a political system that keeps the federal minimum wage at poverty levels for years, a labor rights legal system that is a joke and, of course, a corrupt, wasteful heath care system which drains money out of everyone’s pocket especially at the collective bargaining table where health care costs take up every dime.

To the report. When the original NAFTA was passed, it contained so-called “side agreements” on environmental and labor rights. The quick observer will catch the scam in the idea of “side agreements”: labor and environmental rights were never part of the core part of NAFTA, or any trade agreement, but had to be added on the side for entirely political reasons—Bill Clinton, who was shilling for NAFTA for his corporate contributors, could not sell the deal to a then- Democratic House without pretending to care about workers’ rights. So, he, and his Zelig-like Labor Secretary Robert Reich, concocted these “side agreements” which were supposed to be enforced by an under-funded oversight commission. Along with other legal bribery (promising a bridge here, or a project there, to a handful of Democrats), the bill squeaked by the House.

The “side agreements” were never designed to work—if by “working” you mean protecting workers and allowing independent unions to organize in Mexico. I mean, c’mon, workers don’t even have the real right to organize in the U.S. so it was a blatantly fraudulent notion, and obviously a political gambit, and you have to be a good liar to say with a straight face that labor rights could be enforced in Mexico, a country run, effectively, as a one-party state which opened its arms to multi-national corporations begging to do business in a low-wage country, especially in the maquiladoras set up close to the U.S. border. In fact, most collective bargaining agreements were sham deals ginned up by “official” unions—unions granted recognition by the government without any real input from the workers they were, in theory, going to represent, and, with no free vote by workers on the terms of the collective bargaining agreement. In the local parlance, the deals are known as “protection contracts”—which, correctly, gives you the impression of some Mafia-like dons overseeing the process—because all they do is inzcribe the minimum

legally-mandated benefits and nothing more.

So, along came a 2019 renegotiation of the original NAFTA, into NAFTA 2.0, or, officially, the United States-Mexico-Canada Agreement (USMCA). There were some improvements, to be sure: labor rights—are you ready for this?—were actually written up as an actual part of the main text, not a slapped-on after-thought side agreement (that putting labor rights in the actual text of the deal counts as an improvement tells its own story). And, at least in theory, the U.S, if it chose to, could take enforcement actions under the new agreement against individual factories violating freedom of association and collective bargaining laws, or punish companies that failed to live up to so-called “rules of origin”, which require, for example, that 40-45% of auto content be made by workers earning at least $16-per-hour in order to get the trade deal’s tariff relief.

Maybe the most important anchor of NAFTA 2.0 was a commitment by Mexico to live up to new labor laws that would open the door to registering independent unions and collective bargaining agreements, enforced by new and impartial labor courts.

What did the MSN report find? It was mostly a look at whether workers were able to take part in “legitimation votes”—actually voting for the first time to approve, or reject, an existing collective bargaining agreement (CBA). It is a bit dry and boring so I’ll explain along the way:

Unions in at least three cases have reportedly spread misinformation about what may happen to benefits if workers do not approve the CBA, suggesting that workers will lose benefits if they vote against the contract, or if the union no longer represents them.

While, in most cases, blatant employer interference may not be taking place at the time of the vote, subtle, and not so subtle, messaging to workers about the importance of the current union to the employer and/or false suggestions that workers will lose benefits if they vote against the CBA could take place in the weeks prior to the vote.

And:

A fundamental flaw in the CBA legitimation process is that the organization of the vote, carrying it out,and counting and reporting results is entirely under the control of the incumbent union that currently holds title to the CBA. Although there are only a few examples to date of explicit interference in the process by employers, or intimidation of workers by protection unions, given the history of protection

unionism in Mexico, there is a real danger that employers and traditional unions have and will continue to manipulate the process in order to avoid the possibility that a democratic union will seek to represent the workers

Point—a threat to take away benefits is hardly subtle. This is a classic fox-guarding-the-chicken-coop: the same employers and unions who lorded over this corrupt process are in charge of managing a “legitimation” vote. LOL!

You want an example of a sham?

Roberto Mendoza León is associated with 107 CBAs either listed as General Secretary of two different unions in two different federations, FOS and FOSRM, or through the unions’ legal representative Daniel Gallo Ovilla. These CBAs cover workplaces in seven different economic sectors in multiple states. Salim Kalkach Navarro is listed as General Secretary on 28 CBAs for seven different unions across multiple states and unrelated sectors. These unions are also affiliated with the

CROC. Arturo Omar Rodríguez Martínez is listed as General Secretary on 13 CBAs for one union, affiliated with CONASIM, that represents workers across nine different sectors in multiple states.That a single person could serve as the General Secretary for multiple unions across several unrelated economic sectors in different states at the same time suggests that these are protection contracts. Given that these figures only represent those CBAs that have been subjected to legitimation votes, the number of CBAs to which these union leaders hold title, or the number of sectors where they hold contracts, could be much larger. [emphasis added]

And:

…out of an estimated 530,000 CBAs currently registered with federal and local juntas, as of December 1, according to the Federal Centre’s count, only 2,426 had been subjected to legitimation votes.

The fact that the vast majority of votes that have taken place have approved existing collective bargaining agreements by a wide margin calls into question whether the legitimation process will achieve its intended goal of challenging the protection contract system… [emphasis added]

In regular language: this is a sham.

The upshot: it is hard to see how Mexican workers will, in the near future, truly have a voice in the workplace. Which means they will continue to work for slave-like wages.

And that will just show up in lower wages in the U.S.

SHORT TAKES

Bankers Declare “Incest Is Best”

Be honest: how many of you read the spicey headline and scrolled down? Ok, so, here is a classic example of an entirely unproductive shuffling of assets motivated by a single factor: greed.

This is via the Financial Times (subscription required) just before the end of 2021:

Private equity groups this year struck $42bn worth of deals in which they sold portfolio companies to their own funds, a sharp increase over 2020 in a once-niche type of transaction that can generate handsome payouts to executives.

The deals, known as “continuation fund” sales, involve a buyout group selling a company it has owned for several years to a new fund it has more recently raised. That allows it to return cash to earlier investors within the agreed timeframe, while keeping hold of a company that either has potential to grow or is proving difficult to sell.

And:

When selling a company to their own newer fund, private equity dealmakers still stand to receive payouts of carried interest — a 20 per cent share of profits.

They can then receive a second chunk of carried interest cash later, when the newer fund eventually sells the company. Selling companies to their own funds also helps juice private equity groups’ fee income, because they can continue taking fees from the investors in the new fund that buys it, and in some cases from the portfolio company itself. [emphasis added]

This ranks in the pantheon of sheer greed. These folks are just shifting money back and forth—it’s an accounting scam really with the end result that a few people become fabulously wealthy.

This isn’t some abstract problem: the fulcrum of a vast majority of private equity deals is cutting costs, which almost always means workers lose their jobs. This shuffling of assets just makes that cost cutting even worse, at the expense of workers, because it means even less cash is left in the corporate treasury of the underlying company because that cash is pocketed by a few people—billionaires—who own the private equity funds and walk away with their “2 and 20” (the “2” is the two percent hedge funds, venture capital vultures and private equity pirates charge as a “management fee”—which, as I pointed out recently, often underwrites travel in private jets and staying at luxury hotels on the dime of the investors—and the “20” is the twenty percent these rip-off artists take from profits made).

If there was any honor (ha!) among those who practice capitalism as a pursuit, they would decry this whole practice because, from a purely efficient use of capital, it’s a bloody waste: it is simply a corrupt insiders pickpocket game, relieving investors (including workers’ pension funds) of cash who, at the moment they are being fleeced, are like a mark for a sticky-fingered hustler bumping into you on the street and lifting your wallet. Whoosh! Gone.

Slavery Is All Good In The Name of Money

Wow, when money talks, slavery is all good.

A recap: I’ve been tracking, over the past year or two, the ongoing campaign to end the enslavement of the Uyghurs in the far west region of Xinjiang in China.

China’s leaders and wealthy elites are willing partners of global capitalism, opening up its doors, willingly, to Wal-Mart and huge multinational companies so those companies can produce trillions of dollars of stuff using cheap slave labor—in good capitalist style. Since 2017, China has been conducting a steady campaign of mass transfer of more than a million Uyghurs and members of other Muslim minorities into a vast network of ‘re-education camps’ in Xinjiang, which Uyghur activists call “east Turkestan”.

Think of the Japanese internment camps in the U.S. during WWII or apartheid in South Africa—the key difference, is that this is being driven a lot by the thirst of global capitalism for cheap, slave labor. Tens of thousands of Uyghurs are being forced to work in factories that are in the supply chains of at least 83 well-known global brands in the technology, clothing and automotive sectors, including Apple, BMW, Gap, Huawei, Nike, Samsung, Sony and Volkswagen.

Into this saga come two examples of spineless capitulation to profit and money: Intel and the International Olympic Committee (IOC).

In December, Intel sent a letter to its suppliers that was a pretty pro forma recitation of conditions suppliers had to meet to do business with Intel, including, “Prohibiting any human trafficked or involuntary labor such as forced, debt bonded, prison, indentured or slave labor throughout your extended supply chains.” Understand, Intel doesn’t do this from some deep-seeded place of morality; it’s required to do so to adhere to laws and regulations.

And my evidence to the above? As soon as Intel was attacked on Chinese social media for simply raising the issue, the company folded like a cheap suit:

Intel has apologised for a ban on using components from Xinjiang in response to attacks from Chinese nationalist media over the policy, becoming the latest multinational to become embroiled in China’s battle with the US over human rights issues.

The episode quickly became one of the most talked-about topics online in China with netizens on Twitter-like Weibo calling for the government to hit Intel with fines and other punishments.

The controversy erupted after Intel sent a year-end letter to suppliers noting that components made in the north-western Chinese region of Xinjiang should not be used in its chips. The message attracted the attention of nationalist media outlet Guancha.

In a Chinese language social media post, Intel said it wanted to “clarify” that the ban was only for compliance with US law and not its “own intention or position”.

“We apologise for the trouble caused to our respected Chinese customers, partners and the public,” Intel added.

We apologize… for saying slave labor is immoral…

And not to be outdone, the always corrupt IOC will opt to pocket money from sales of branded clothing and others items:

Companies may be unable to guarantee that their products are not made with forced labor, especially given China’s restrictions on outsiders in Xinjiang. But the Olympic committee appears reluctant even to try, members of the coalition said — echoing the concerns of other human rights groups.

And:

The I.O.C. also has ties to companies that use Xinjiang cotton. The committee’s official sportswear uniform supplier is Anta, a Chinese sportswear giant that has affirmed its commitment to Xinjiang cotton.

Inheritance Scams

The superrich we often hear about are the bombastic, ego maniacs like Elon Musk and Jeff Bezos. But, the superrich who control vast fortunes are as likely to be relatively obscure people, even if their wealth is tied up in very recognizable names like Mars, Scripps and Mellon.

And it’s those three families that ProPublica shines a light on in another terrific expose on how the superrich undermine society and dodge taxes, and have done so across generations:

With each new rewrite of the tax code, the superrich deploy clever trusts and armies of lawyers and lobbyists to find ways not to pay. Even legislation specifically designed to prune fortunes before they pass to the next generation has not been much of an impediment.

Take the estate tax, which was established in 1916, and has never quite worked the way Congress intended. Over the years the rates have changed, but the goal of taxing the wealthiest Americans has remained. This year, the estate tax applies to couples worth more than $23.4 million.

Faced with taxes at death, some of the rich simply passed their fortunes to their heirs while they were alive. So Congress enacted a tax on those gifts. Enterprising parents got around the full bite of estate taxes by skipping their kids and giving their wealth to their grandchildren. Then came the 1976 tax imposed on gifts that skip a generation. Throughout, the ultrarich have stayed one step ahead.

The estate tax has eroded to the point that last year the estates of just 1,275 people in the whole country owed the tax — down from a peak of 139,000 in 1976 — despite historic amassing of wealth by the very richest.

The estate tax essentially has become voluntary for the ultrawealthy, paid only if “you’re unwilling to take the time and pay lawyers to plan around the tax,” said Alice Abreu, a tax law professor at Temple University.

Neither of the main levers the government has to rein in dynastic wealth and inequality — income and estate taxes — is working, she said, noting that their failure also deepens racial divides as the modern aristocrats, like their forebears, are overwhelmingly white.

“The ultimate consequence,” Abreu said, “is the very real threat to democracy that we’re facing right now.”

You should read the entire report.

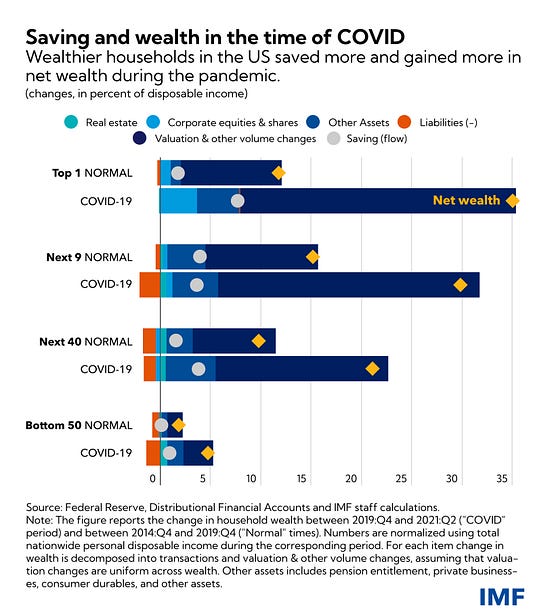

Chart of The Day--Unequal COVID Wealth Growth

Astute followers of news that you all are, I’m guessing you’ve seen the reports detailing how much richer people like Jeff Bezos and Elon Musk have become during the pandemic—as in hundreds of billions of dollars richer.

Here’s a bit more on what has happened via the International Monetary Fund (yes, I always say: I’m not a fan of the IMF—it’s history of imposing structual adjustment on countries in return for money is deplorable).

The key points to remember here, as the IMF writes:

The overall increase in net wealth, in percent of disposable income, was considerably larger during the pandemic (between the end of 2019 and the second quarter of 2021) than during normal times (between the end of 2014 and end of 2019).

It was driven mainly by valuation changes (due to booming equity and housing prices) as well as, to some extent, by the “COVID saving surge” (with a jump in “other assets,” including bank deposits).

This overall increase in net wealth was also unevenly distributed, with much of it accruing to people at the top of the distribution. Indeed, the equity price boom mostly benefitted the rich, while lockdowns more heavily affected spending on dining and travel, which make a larger part of wealthier households’ consumption habits. Additionally, government support, in the form of direct stimulus or support to firms, also benefitted the saving of wealthier households compared to poorer households that were more likely to spend the extra cash.

In other words, as usual, the richest in society do better than everyone else because they continue to pile up wealth as their assets appreciate largely because they don’t have to spend any extra cash on trying to survive.

If you liked this post from Working Life Newsletter, why not share it?