|

A Wealth Tax: $414 Billion For The People (Part 3—The State-Based Campaign)

The Time Is Now—And It's Unifying.

Why You Might Want To Read This: Today’s post wraps up a three-part series with a general overview of a state-based campaign to advance Wealth Taxes (I truly appreciate the patience of my readers who were only mildly interested and put up with THREE emails in one week). To reiterate, the silver lining in the immoral, awash-with-phony-math Republican tax bill is that it laid the ground for a state-based campaign to win wealth taxes, especially in the states with citizen initiatives. To read Part 1, go here. To read Part 2, go here.

Top line concepts

Since there is zero chance to advance a wealth tax at the federal level, I am advocating a 2026 unified, state-based, coordinated campaign anchored on ballot initiatives, along with legislative efforts AND don’t ignore so-called “red” states.

As important: I’m betting that the theme of “the rich are stealing us blind and hurting you and your community” is a unifying thread that can pull together the broadest group of people. C’mon, who doesn’t see the obvious?

For the sanity of you’all, I’ll be relatively brief below and general, leaving scores of details to my notebook.

Is there support?

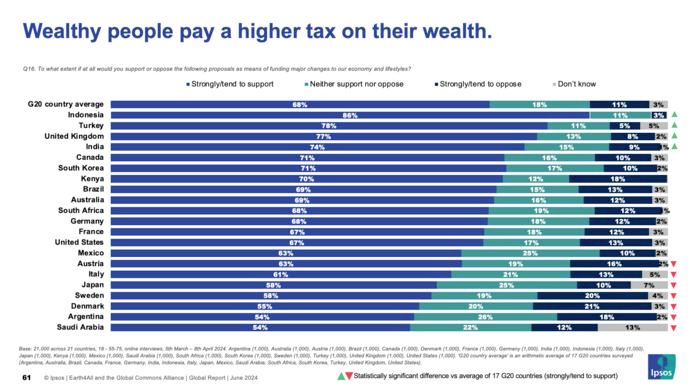

Any campaign starts with some sense of the support for the idea. In the below global poll from a year ago, 67 percent of those asked in the U.S. supported a higher tax on wealth.

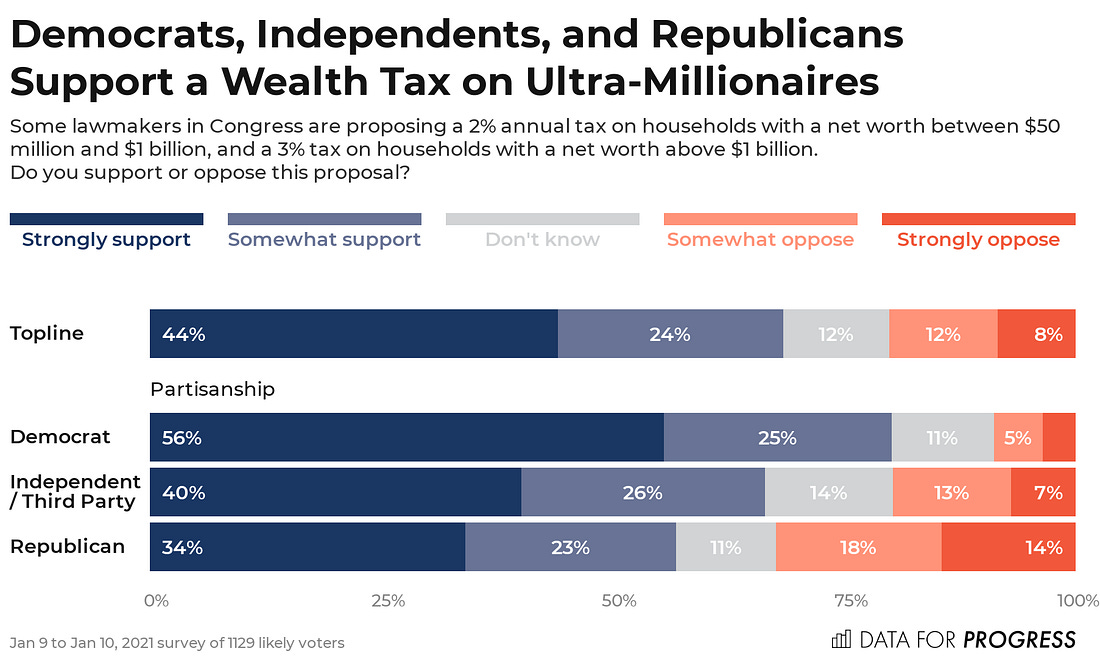

An earlier poll in 2021 showed similar results:

If one is thinking of opposition, well, it’s hard to find hard-core opposition even among Republican voters who show strong/some support for a wealth tax, at roughly 57 percent overall.

So, where could this be pushed?

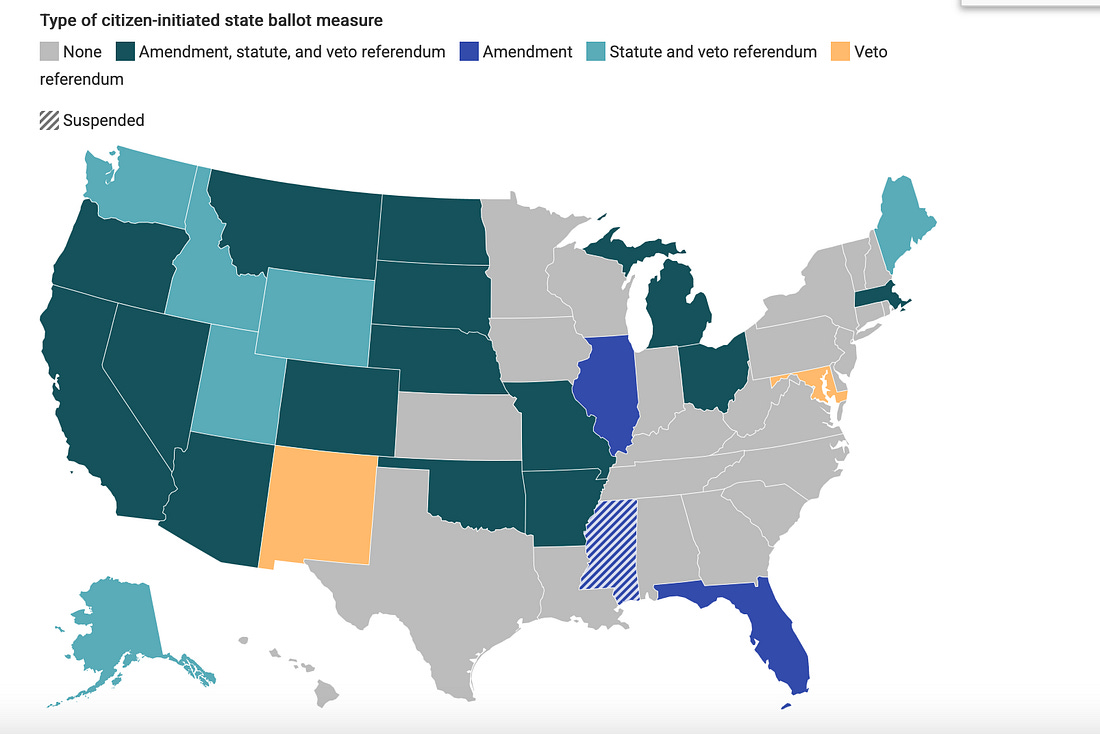

Anchor the effort in the 26 states with statewide initiative and/or referendum, all with different rules guiding each one (this is a good guide to the rules). Those states are split *roughly* 50/50 between so-called “blue” and “red” states:

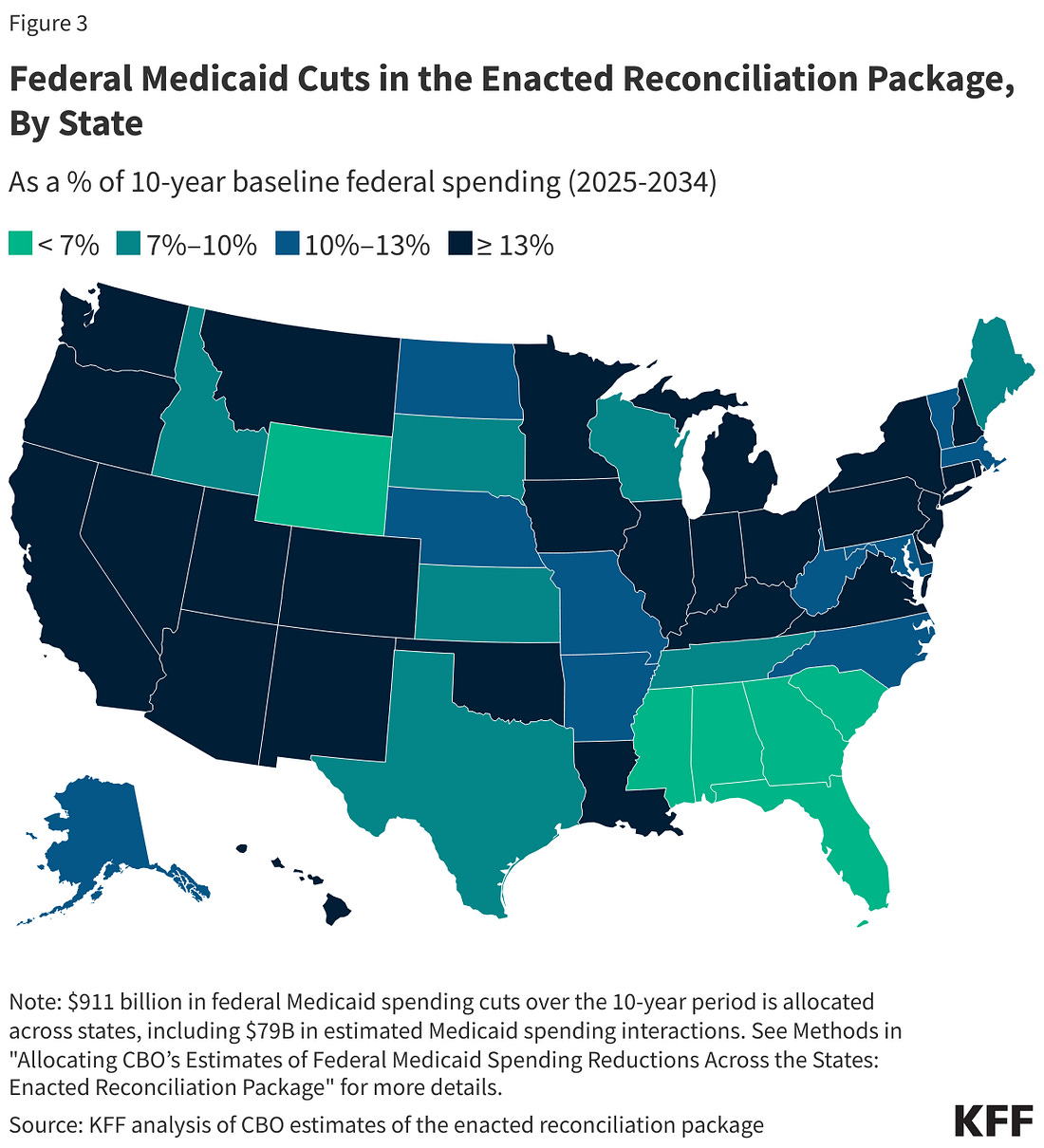

One interesting tidbit: I’ve reprinted the below chart from Post #1. Note the overlap of states facing significant cuts in federal medicaid that also have the right to citizen-initiated state ballot measures per the chart above.

What this tells us is that there is a huge opportunity to speak to people across the political spectrum, in part because the Medicaid cuts touch every corner of a state, urban or rural, and will hurt people no matter who they happen to vote for.

The Coalition: This needs to be a unified effort.

You think that’s not doable?

Here are the organizations already supporting an ultra-millionaire tax proposed in Congress by Elizabeth Warren and Pramila Jayapal—a proposal that has ZERO, none, zilch, nada chance of passing anytime in the next…20-30 years…and is just, with great respect to the advocates, a performative gesture (note: Six years ago I discussed Warren’s essentially similar proposal on my podcast):

AFL-CIO, AFSCME, American Federation of Teachers, Americans for Financial Reform, Americans for Tax Fairness, Center for Law and Social Policy, Climate Hawks Vote, Coalition on Human Needs, CWA, Take on Wall Street, Health Care for America Now, Indivisible, Institute on Taxation and Economic Policy, Jobs with Justice, Liberation in a Generation, Main Street Alliance, MomsRising, National Domestic Workers Alliance, National Education Association, Network Lobby for Catholic Social Justice, Oxfam America, P Street, Patriotic Millionaires, People's Action, Progressive Change Campaign Committee, United Steelworkers, Public Citizen, Sunrise Movement, SEIU, United for Respect, Unemployed Workers United, AFGE, and Voices for Progress.

Instead of wasting money and time on a federal tax gambit that has no chance of passing, or the PRO Act, which, as I wrote, will never pass and has no traction among the general population, the unions listed above, and every other union, should pour millions into a state-based, 2 percent wealth tax across the nation.

Speaking directly to labor’s interest, victory on wealth taxes at the state level is in the interest of:

Every public sector union because it will ensure that tens of thousands of public sector workers keep their jobs and, in fact, funds are banked to expand the public sector;

Every private sector union because a drain in public sector finances will drag down economic activity generally (building trades: think simply about the infrastructure jobs lost, or, optimistically, gained).

The Hub: Smoothing Out The Chaos

No other way of saying it: Right now, the very rich get away with this scam because the opposition is a jumble of chaos and disorganization, with multiple efforts voicing opposition to the myriad economic and political crisis at hand: No Kings, Bernie Sanders’ one-man “Oligarchy” show, Indivisible...the list is endless. Acknowledgement: For the sake of keeping our eyes trained on wealth taxes, I’m sidestepping, for the moment, the legitimate debate about who in the “opposition” wants deep, systemic changes in the economic system, as opposed to tinkering around the edges.

Prove me wrong (in the comments below!):

Virtually every organization, or part of society an organization represents, has something at risk because the very rich do not pay up;

Virtually every organization, or part of society an organization represents, has as part of its mission advancing an idea that would move forward if the very rich paid up;

Virtually every organization, or part of society an organization represents, would find itself in a better place to do its work if each state had more money to deploy (say, health care or climate change infrastructure);

We need a Hub to coordinate the multi-state campaign:

To be the resource to understand every nuance of a ballot campaign, or legislative effort, and make resource decisions;

To structure the same language for each measure, unless the specific initiative rules prohibit certain language, so we can organize across the nation in a unified fashion;

To be strategic where to deploy, or pull back, resources;

Forget “Red” and “Blue”

The opportunity to be creative screams out. I won’t go state-by-state here because it would be a book. Just a taste.

In 2018 and 2019, teachers rose up, in an unprecedented fashion in a movement called “Red for Ed”. The uprising was most prominent in traditional “red” states: Arizona, West Virginia, Oklahoma, Kentucky and North Carolina (if you want to dig deeper into the teacher uprisings, you can listen to my podcasts at the time for West Virginia, Arizona, Oklahoma and North Carolina). In West Virginia, for example, a right-to-work state where it’s illegal for teachers to strike, the teachers in all 55 counties struck; the teachers smartly recruited parents and superintendents to the cause, with a large majority of the county education boards signing a letter of support.

What is relevant here: in a number of states, the “Red for Ed” movement managed to either increase state taxes on the wealthy or roll back a proposed tax cut for the rich. The winning campaigns did so with broad non-teacher support—parents, in particular—because it brought home a very stark contrast: the interests of kids versus the interests of the very rich.

In 2020, for example, Proposition 208 in Arizona passed by a margin of more than 116,000 votes, a larger margin that Joe Biden’s slim margin in the state. It put a 3.5 percent tax on the wealthiest people to fund higher salaries for teachers, school aides, bus drivers and other folks, not to mention higher spending per student which would mean smaller class sizes.

And, then, there is a “hybrid” like New Mexico: it only has a “veto referendum”, allowing voters to uphold or repeal a law. But, it also has one-party control: The Democratic Party controls the governorship, secretary of state, attorney general, and both chambers of the state legislature—and, of course, yes, that doesn’t mean those elected Democratic Party critters are populist mavericks.

But, New Mexico is also one of the poorest states and will be hit hard:

The state is among the biggest per capita recipients of federal money, taking in $3 for every dollar it sends in taxes. About 39 percent of its residents are on Medicaid — one of the highest rates in the country — and 23 percent receive food assistance.

AND:

The state estimates that it will lose $2.8 billion annually in Medicaid funding, and as much as $352 million from the Supplemental Nutrition Assistance Program, or SNAP, which helps low-income families buy groceries. Six to eight rural hospitals could close within the next 24 months.

AND:

And out of roughly 22,000 jobs in state government, more than 2,000 are wholly funded by the federal government, while an additional 3,800 are partially funded…

AND

The New Mexico Health Care Authority, which administers Medicaid and SNAP, estimates that 88,000 residents could lose Medicaid, and 58,000 could lose SNAP.

So, there are also options to advance a wealth tax in the legislature, with pressure from a well-coordinated campaign.

I think you’all get the point. You can go state-by-state and, my rough guess, see legitimate, winnable Wealth Tax campaigns in two-thirds of the states.

Take Field Work *Competence* Seriously

The bench is thin in many states for competent, on-the-ground field organizers. The Hub should put a premium on grappling with a long-term problem. Unions give lip service to organizing but, too often, the money isn’t there and organizing is not where the best people often end up.

A crucial barrier that’s worth *trying* to solve, and I don’t have the magic bullet: outside of unions, how can political organizing become a full-time job with a livable wage, not simply a slot that appears during an election cycle, pays so-so wages without benefits, and, then, is gone after Election Day, relegating some of the potential great organizers to hustling to find a new job.

I can confidently say this: the hundreds of millions of dollars pissed away on media buys every election cycle, 15-20 percent of it going to consultants, could instead be used to stand up a permanent, decently paid field operative universe.

Make It A “Must” For Any Endorsement + Real Efforts

This is a chance to smoke out the “free market” shills in the political arena. As I detailed in Post #2 in this series, there is no credible argument against a Wealth Tax. None. If an incumbent or candidate hems and haws and tries to shovel rhetorical manure at folks to dodge giving support to a Wealth Tax, then, you know s/he should not hold office. Period.

Let’s make this a core demand: endorse and actively campaign for the Wealth Tax if you want to be endorsed.

Not just by filling out a questionnaire, which is never binding and plenty of candidates feel quite at ease lying in their answers (I mean, Barack Obama, when he first ran for president, shamelessly said in front of multiple union audiences—I was there—that if elected, he’d put on his walking shoes and join strikers on the picket line… I will pay $500 to a person who can show a single instance of that ever happening…save yourself the time). Actually, putting out the political and resource capital to win.

Winning Isn’t Everything

In this series, I’ve made the case for the Wealth Tax math, eviscerated the very weak objections to a Wealth Tax and, finally, laid out the broad overview of a very winnable campaign.

That said, winning isn’t everything (with apologies to Red Sanders). It’s possible, for reasons one can’t predict into the future, that some campaigns will fall short.

I am convinced that, done right, win or lose, talking about wealth taxes to people in every community will plant the seeds for true, deep economic changes.

You're currently a free subscriber to Working Life Newsletter. For the full experience, upgrade your subscription.