|

The COP26 Fraud--The Boundless Bull Balderdash

SHORT TAKES: Passing Wind (And Sun)--A Big Thing In Republican States; Invasion Of The GRAT Snatchers; Grounding Those Private Planes

| Jonathan Tasini | Nov 11 |

LONG TAKE

Greta Thunberg is right when she called COP26 a “PR event” and said:

It is not a secret that COP26 is a failure. It should be obvious that we cannot solve a crisis with the same methods that got us into it in the first place…The people in power can continue to live in their bubble filled with their fantasies, like eternal growth on a finite planet and technological solutions that will suddenly appear seemingly out of nowhere and will erase all of these crises just like that.

Here is what I think Thunberg meant, and I agree with her: the free-market economic system, which allows corporations to basically do as they please, is the source of the planetary climate crisis. So, to believe that the path to saving the planet from further climate damage goes through the *same* system is madness and corrupt.

Essentially, COP26 is an admission of failure—not simply failure to reverse climate change (at this point, I agree with those that view the task before us is simply stemming the worst consequences of the damage to date) but even more so it’s a failure to impose a different economic system that replaces free-market capitalism.

COP26 is a capitulation—which I think Thunberg and the younger activists see more clearly than old folks.

Break it down:

There is a reason 2/3 of the economy in the U.S. is powered by consumer spending: the entire free-market system is devoted to making people want more stuff which the system—tun by corporations—is happy to provide by churning out more stuff, which means using more and more finite planetary resources;

That “buy culture” is adopted by most countries in the world—even when certain populations don’t have the income to play the game of over-the-top consumerism—which translates into indentured servitude to pay off debt.

The entire system is propped up by slave/cheap labor and the now familiar “supply chains” (which, amusingly, is a concept few people used in daily language until six months ago), which are not going away.

And this is the system that is killing the planet. And killing people and other species.

And the problem is that lots of people—including “progressives”—are playing the game. Thousands of people who populate hundreds of little non-profit Non-Governmental Organizations (NGOs) descend on these COP meetings, taking selfies and feeling very, very important and, then, sending in reports to their foundation benefactors—foundations that, more often than not, are built on fortunes made by a mixture of economic piracy, exploitation and plunder (think “Rockefeller”). The folks, who mean well, accomplish very little other than being props for what goes on in rooms far from the glare of protests and sign-waving. More important, they know the limitations in which they operate—meaning, what they can get away with in order to keep the grants and money flowing: it is all about economic *reform*, NOT TRANSFORMATION, which means leaving in place the basic economic system.

All of this in the service of promoting the culture of the Boundless Bull, a term coined by Herman E. Daly, who was a senior economist at the World Bank from 1988 to 1994 but left the institution, which tried unsuccessfully to muzzle him. Daly, once a free-trader, wrote an essay some years ago which I have quoted before—it’s worth revisting briefly here and, then, offering up some more of Daly’s insights to put COP26 in the right frame.

A bit of context for the younger folks who never saw this iconic television ad (yes, I actually saw it in the day…)—it featured a wandering big bull as a metaphor for the economy and, by extension, the power of Merrill Lynch—quite ironic since Merrill Lynch went belly up during the Global Financial Crisis and was bought by another scoundrel company, Bank of America:

If you want to know what is wrong with the American economy it is not enough to go to graduate school, read books, and study statistical trends-you also have to watch TV. Not the Sunday morning talking-head shows or even documentaries, and especially not the network news, but the really serious stuff-the commercials…One such ad opens with a bull trotting along a beach. He is a very powerful animal-nothing is likely to stop him. And since the beach is empty as far as the eye can see, there is nothing that could even slow him down. A chorus in the background intones: ‘to…know…no…boundaries…’ The bull trots off into the sunset…Finally we see the bull silhouetted against a burgundy sunset, standing in solitary majesty atop a mesa overlooking a great empty southwestern desert…”

“The message is clear: Merrill Lynch wants to put you into an individualistic, macho, world without limits-the U.S. economy. The bull, of course, also symbolizes rising stock prices and unlimited optimism, which is ultimately based on this vision of an empty world where strong, solitary individuals have free reign…Why do they want you to believe it, or at least be influenced by it at a subconscious level? Because what they are selling is growth, and growth requires empty space to grow into. Solitary bulls don’t have to share the world with other creatures, and neither do you! Growth means that what you get from your bullish investments does not come at anyone else’s expense. In a world with no boundaries the poor can get richer while the rich get richer even faster. Our politicians find the boundless bull cult irresistible.”

And, then, further on in the essay, Daly points out how we fail to distinguish between types of growth:

An economy can therefore develop without growing, or grow without developing…The advantage of defining growth in terms of change in physical scale of the economy is that it forces us to think about the effects of a change in scale and directs attention to the concept of an ecologically sustainable scale, or perhaps even of an optimal scale.’ He sums up by arguing that “the apt image for the U.S. economy, then, is not the boundless bull on the empty beach, but the proverbial bull in the china shop. The boundless bull is too big and clumsy relative to its delicate environment. Why must it keep growing when it is already destroying more than its extra mass is worth? Because (1) We fail to distinguish growth from development, and we classify all scale expansion as ‘economic growth’ without even recognizing the possibility of ‘anti-economic growth’-i.e. growth that costs us more at the margin; (2) we refuse to fight poverty by redistribution and sharing, or by controlling our own numbers, leaving ‘economic’ growth as the only acceptable cure for poverty. But once we are beyond the optimal scale and growth makes us poorer rather than richer, even that reason becomes absurd.” [emphasis added]

Daly has a companion 2015 piece, “Economics for a Full World,” (which I will partly except here but you can, and should, read the entirety here) which challenges the entire idea that the planet can be rescued if we still foster an economic system that rests on more growth:

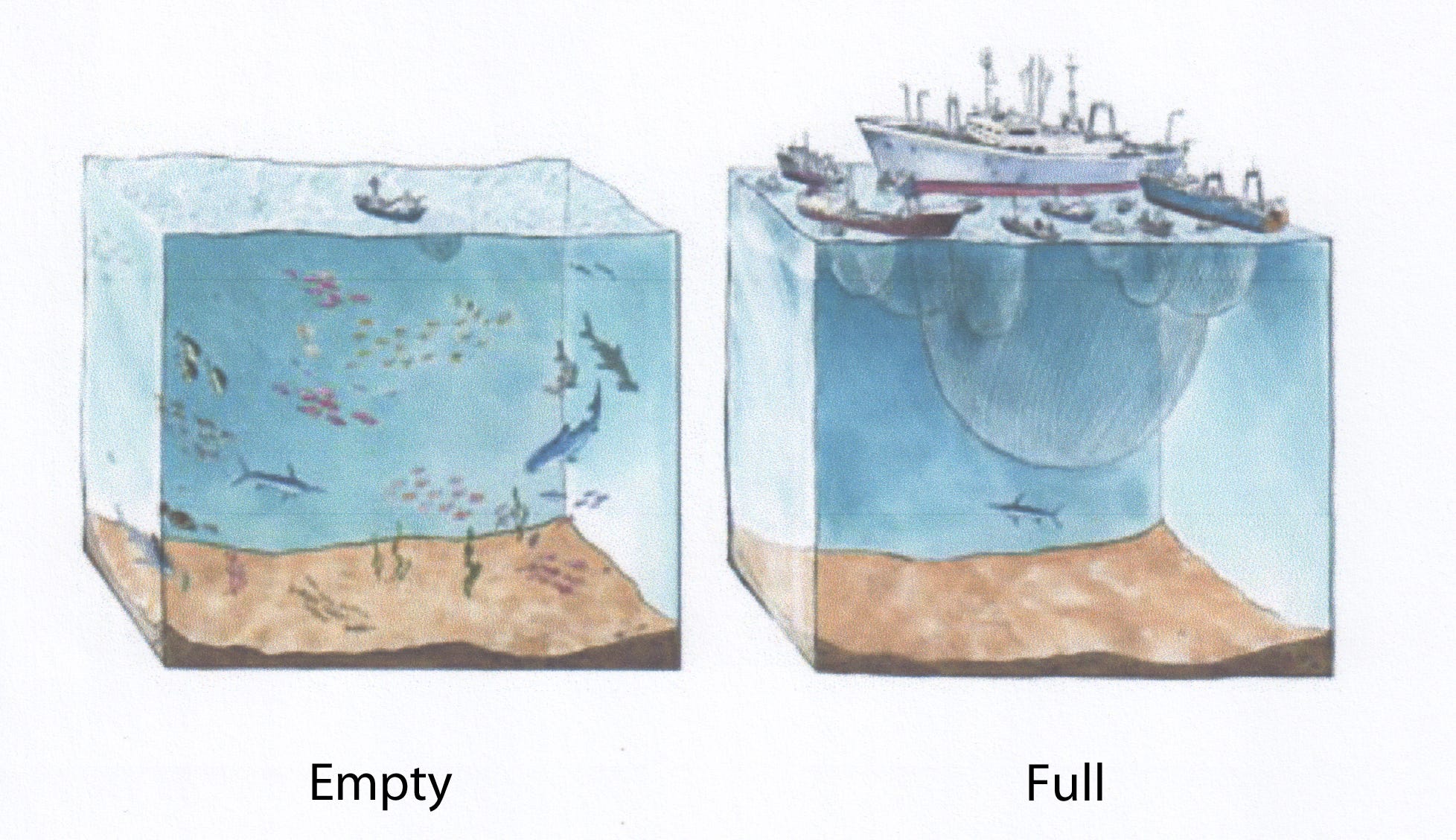

Some believe that we still live in an “empty” world. In the empty world, the economy was small relative to the containing ecosystem, our technologies of extraction and harvesting were not very powerful, and our numbers were small. Fish reproduced faster than we could catch them, trees grew faster than we could harvest them, and minerals in the Earth’s crust were abundant. In other words, natural resources were not really scarce. In the empty world, it made economic sense to say that there was no conflict between economic growth and the ecosystem, even if it were not strictly true in a physical sense.

…But the empty world has rapidly turned into a “full” world thanks to growth, the number one goal of all countries—capitalist, communist, or in-between. Since the mid-twentieth century, the world population has more than tripled—from two billion to over seven billion. The populations of cattle, chickens, pigs, and soybean plants and corn stalks have as well. The non-living populations of cars, buildings, refrigerators, and cell phones have grown even more rapidly. All these populations, both living and non-living, are what physicists call “dissipative structures”—that is, their maintenance and reproduction require a metabolic flow, a throughput that begins with depletion of low-entropy resources from the ecosphere and ends with the return of polluting, high-entropy waste back to the ecosphere. This disrupts the ecosphere at both ends, an unavoidable cost necessary for the production, maintenance, and reproduction of the stock of both people and wealth. Until recently, standard economic theory ignored the concept of metabolic throughput, and, even now, its importance is greatly downplayed.

He uses this graphic to illustrate:

Daly, then, makes this point:

Nonetheless, we perversely continue to call it economic growth. Indeed, you will not find the term “uneconomic growth” in any macroeconomics textbook. Any increase in real GDP is called “economic growth” even if it increases costs faster than benefits. That richer (more net wealth) is better than poorer is a truism. The relevant question, though, is, does growth still make us richer, or has it begun to make us poorer by increasing “illth” faster than wealth?

Examples of “illth” are everywhere, even if they are still unmeasured in national accounts. They include things like nuclear wastes, climate change from excess carbon in the atmosphere, biodiversity loss, depleted mines, deforestation, eroded topsoil, dry wells and rivers, sea level rise, the dead zone in the Gulf of Mexico, gyres of plastic trash in the oceans, and the ozone hole. They also include exhausting and dangerous labor and the un-repayable debt from trying to push growth in the symbolic financial sector beyond what is possible in the real sector. [emphasis added]

Daly advocates a “steady-state” economics:

It does not attempt to eliminate the subsystem boundary, either by expanding it to coincide with the whole system or by reducing it to nothing. Rather, it affirms both the interdependence and the qualitative difference between the human economy and the natural ecosystem. The boundary must be recognized and drawn in the right place. The scale of the human subsystem defined by the boundary has an optimum, and the throughput by which the ecosphere physically maintains and replenishes the economic subsystem must be ecologically sustainable. The goal of the economy is to minimize the low-entropy used up to attain a sufficient standard of living—by sifting it slowly and carefully through efficient technologies aimed at important purposes. The economy should not be viewed as an idiot machine dedicated to maximizing waste. Its ultimate purpose is the maintenance and enjoyment of life for a long time (not forever) at a sufficient level of wealth for a good (not luxurious) life. [emphasis added]

And here are the policies to get there:

(1) Developing Cap-Auction-Trade systems for basic resources (especially fossil fuels): Set caps for natural resource according to three key rules: (1) renewable resources should not be depleted faster than they regenerate, (2) nonrenewable resources should not be depleted faster than renewable substitutes are developed, and (3) wastes from all resource use should not be returned to the ecosystem faster than they can be absorbed and reconstituted by natural systems. This approach achieves sustainable scale and market efficiency, avoids rebound effects, and raises auction revenue for replacing regressive taxes.

(2) Tax shifting: Shift the tax base from “value added” (labor and capital) to that to which value is added, i.e., natural resource throughput, the source of social costs such as pollution and adverse public health effects. Such taxes will also encourage efficient resource use.

(3) Limiting inequality: Establish minimum and maximum income limits, maintaining differences large enough to preserve incentives but small enough to suppress the plutocratic tendencies of market economies.

(4) Reforming the banking sector: Move from a fractional reserve banking system to 100% reserve requirements on demand deposits. Money would no longer be mainly interest-bearing debt created by private banks, but non-interest-bearing government debt issued by the Treasury. Every dollar loaned for investment would be a dollar previously saved by someone else, restoring the classical balance between investment and abstinence from consumption, and dampening boom and bust cycles.

(5) Managing trade for the public good: Move from free trade and free capital mobility to balanced and regulated international trade. While the interdependence of national economies is inevitable, their integration into one global economy is not. Free trade undercuts domestic cost-internalization policies, leading to a race to the bottom. Free capital mobility invalidates the basic comparative advantage argument for free trade in goods.

(6) Expanding leisure time: Reduce conventional work time in favor of part-time work, personal work, and leisure, thereby embracing well-being as a core metric of prosperity while reducing the drive for limitless production.

(7) Stabilizing population: Work toward a balance in which births plus in-migrants equals deaths plus out-migrants, and in which every birth is a wanted birth.

(8) Reforming national accounts: Separate GDP into a cost account and a benefits account so that throughput growth can be stopped when marginal costs equal marginal benefits.

(9) Restoring full employment: Restore the US Full Employment Act of 1945 and its equivalent in other nations in order to make full employment once again the end, and economic growth the temporary means. Un/under-employment is the price we pay for growth from automation, off-shoring, deregulated trade, and a cheap-labor immigration policy. Under steady-state conditions, productivity improvements would lead to expanded leisure time rather than unemployment.

(10) Advancing just global governance: Seek world community as a federation of national communities, not the dissolution of nations into a single “world without borders.” Globalization by free trade, free capital mobility, and free migration dissolves national community, leaving nothing to federate. Such globalization is individualism writ large—a post-national corporate feudalism in a global commons. Instead, strengthen the original Bretton Woods vision of interdependent national economies, and resist the WTO vision of a single integrated global economy. Respect the principle of subsidiarity: although climate change and arms control require global institutions, basic law enforcement and infrastructure maintenance remain local issues. Focus our limited capacity for global cooperation on those needs and functions that truly require it.

The above is not, by in large, the agenda of COP26. And that is the reason it is a fraud if one thinks that all that energy—and carbon emissions emitted to get to the meetings!—is going to transform the economy.

It won’t.

SHORT TAKES

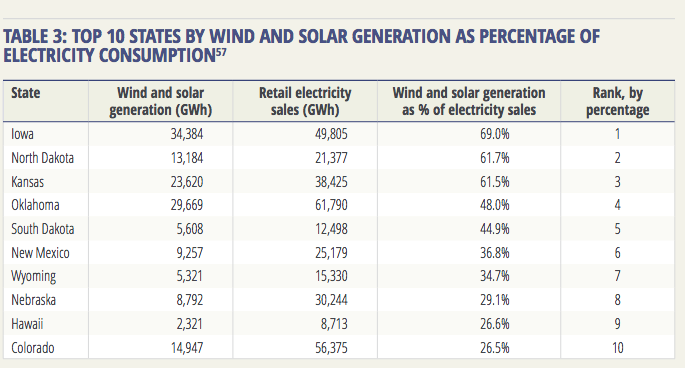

I find this illuminating. Quick: which states are the most aggressive in relying on solar and wind power generation? So-called “blue” states, right? Bzzzzz… thanks for playing but no…

As the table below shows, the top five states—and 7 out of the top 10—are states that voted for Donald Trump in 2020.

Now, let’s be clear: this has nothing to do with either a newly-discovered belief in climate change or the Republican rhetoric of the so-called “free market”. Nope. In fact, it comes directly from two things that the whack jobs rail against from FOX News to the floor of the Congress: a whole raft of tax incentives (which create managed markets, not “free” markets”) and public investments—Texas (!!!), for example, has invested $7 billion in its grid, an investment completed in 2013, so wind energy from the state’s windiest regions could be shuttled to its biggest cities.

You might ask—go ahead, ask—what form of life is a GRAT? It’s yet another scam actually the rich use to dodge taxes: a grantor retained annuity trust.

Our friends at the Institute for Taxation and Economic policy explain:

But under a GRAT, extremely wealthy people can place their assets into trusts designed to benefit their heirs, and much of the gains on those assets over time are never subject to estate or gift taxes. If this sounds like a major problem for the integrity of the estate tax, that’s because it is.

The GRAT is such a powerful and straightforward way to dodge the estate tax that lawyers who help their clients employ the strategy have referred to it as an “off-the-shelf solution” for tax-averse wealthy people. All told, the lawyer who pioneered the use of GRATs estimates that they sliced the estate and gift taxes by about one-third between 2000 and 2013, for a loss of about $100 billion in federal revenue over that period and billions more in states that levy estate taxes. With wealth inequality continuing to soar, that figure has surely ballooned even further since then. And GRATs are just one of many strategies that wealthy families are using to escape the estate tax. Tax attorney Robert Lord recently declared that the loopholes have gotten so out of hand that “the estate tax is entirely avoidable.”

Why bring this up now? Well, the House version of the Build Back Better bill (to reiterate, I hate that name) had a provision to weaken this rich person’s tax dodge—but it was stripped out of the final version that sits before the House. I reckon there will be a try by people like Bernie Sanders to put it back in the final bill when it eventually reaches the Senate but…yup, the billionaires personal two-person caucus (Manchin and Sinema) will likely nix that idea.

So, wealthy families get to continue the robbery of the people.

Big investors don’t care about bad behavior as long their bank accounts continue to fill up. But, some crooks are starting to test even investors patience.

It’s hard to find a more rapacious, badly-behaved, bordering-on-crooked collection of folks then the private equity (PE) world. It starts with the fundamental structure of these private equity funds and the infamous “2 and 20” compensation—the 2 percent the PE pirates charge as a “management fee” on the total assets they manage and, THEN, the 20 percent they take on top of that on any profits made.

Hidden in that “management fee” are a whole raft of expenses, including, we learn, the use of private jets by the PE executives. Well, it’s starting to irritate the investors, per the Financial Times (subscription):

Investors say they routinely find themselves billed for extra costs, such as the hiring of private jets, in addition to the standard “two and 20” — a 2 per cent annual management fee and 20 per cent performance fee — charged by the managers of private equity groups, known as general partners or GPs. “Expenses are the biggest cause of misalignment between GPs and their clients,” said an investor running a multibillion-dollar private equity portfolio.

And:

A quarter of investors are paying for administrative expenses for private equity managers, such as in-house legal services, accounting and computer software, according to ILPA.

The legal costs to set up new private equity funds have more than doubled since 2011, a bill that is also paid by investors who are also having to stump up for new expenses such as cyber security services for GPs.

KKR, the world’s second largest private markets manager by assets, has reported that it earned $480m in capital market fees and a further $152m in “additional fees” including monitoring and transaction fees in 2020.

I always like to pose this question to give the right weight to the term “crooks”: could you, or anyone you know, get away with a similar scam?

If you liked this post from Working Life Newsletter, why not share it?