|

Robbing Seniors To Make Big PHARMA CEOs Rich

SHORT TAKES: Black Unemployment Is A Lot Worst Than You Think; The Real Estate and Oil Scammers; Gas Prices In Perspective; Cold War Heats Up On Two Sides Of The Globe

| Jonathan Tasini | Dec 9 |

LONG TAKE

Here we have perhaps the classic example of how to rip off people, especially seniors, and line the pockets of entirely amoral, greedy CEOs. Buckle up, folks.

Background: me, being the positive type, would note that the Fall started with a bit of good news for 70 million Americans, mostly seniors—the Social Security Administration announced that monthly Social Security payments would go up 5.9 percent starting in 2022 mainly because the cost of living index (the Consumer Price Index, CPI) rose because of inflation.

Now, a few caveats. Social Security benefits are too low and I’ve long made the point that the CPI doesn’t fully measure what it costs to pay basic monthly bills, especially if you live in a place where rents are rising much faster than wages or benefits. On the other hand, if, as I believe (along with a lot more smarter people), that the current inflation rate is transitory and will abate once the pandemic-related hiccups work themselves out—especially noting that, surprise, corporations are making huge profits even as they raise prices to allegedly account for inflation because…capitalism—the monthly Social Security payment increase of 5.9 percent will still be baked in and go a bit further. So, the increase in Social Security benefits is a bit of good news, to be tempered as well.

Then, just as they were happy to get the Social Security news, boom, seniors got a different piece of news: Medicare premiums for Part B will rise for about 57 million beneficiaries 14.55 percent—from $148.50 to $170.10) beginning next year.

So, that Social Security rise was effectively wiped out—and then some.

Now, why the sudden Medicare hike?

The answer is simple—the greed of one company: Biogen.

And, specifically, the greed embedded in the company’s pricing of Aduhelm, a drug that, in theory, combats Alzheimer’s.

Biogen, you see, has priced this drug…are you sitting down… at $56,000—which is roughly six to 20 times more than what independent analysts say it should cost. And, to boot, it’s not even clear that the drug will work or that it’s safe.

To explain this story, I’m going to put here a significant piece of the letter that Bernie Sanders wrote to Biden urging him to delay the Medicare hike:

If 1 million Medicare beneficiaries take Aduhelm, the Kaiser Family Foundation estimates total spending on the drug will reach $57 billion in a single year. This is more than Medicare Part B spent on all drugs in 2019 ($37 billion).

In my view, it would be absolutely unacceptable to force 57 million senior citizens to pay $11.50 more a month in Medicare premiums due to Biogen’s greed and thirst for massive profits for a drug that has not been proven to be effective by the scientific community and has been rejected for coverage by the Veterans Health Administration and at least a half a dozen private health insurance companies in the United States.

It would be equally unacceptable to force seniors suffering from Alzheimer’s disease to come up with a 20 percent co-payment of $11,200 out of their own pockets for Aduhelm – which is precisely what they would have to pay if Biogen is allowed to charge $56,000 for this drug. [emphasis added]

And:

Biogen’s $56,000 price of Aduhelm is the poster child for how dysfunctional our prescription drug pricing system has become. The notion that one pharmaceutical company can raise the price of one drug so much that it could negatively impact 57 million senior citizens and the future of Medicare is beyond absurd. With Democrats in control of the White House, the House and the Senate we cannot let that happen. [emphasis added]

This brazen attempt at robbery by one drug company is a brutal example of the corruption in politics playing out almost daily before your very eyes, and a reason a healthy slice of voters seem repelled by what the Democratic Party is up to.

What is the easiest, no-brainer idea—one that would be good for the economy, meaning, good for working class and middle class people—floated in the past say six months (and far longer): let Medicare negotiate drug prices.

Which industry has almost no competitor to the vast profits it pockets at the expense of regular people? Big PHARMA.

And, yet… because a handful of Democrats are in the pockets of Big PHARMA—paid off with campaign contributions—that no-brainer idea is dead, held hostage by the Manchins and Sinemas of the world. I’ve pointed out before this little nugget, which rarely gets mentioned: Manchin’s shilling for Big PHARMA is a family affair: his daughter, Heather Bresch, pocketed over $113 million as the CEO of Mylan while raising the price of the life-saving EpiPen five times to make it unaffordable for many. So, robbing seniors is just another day at the office for Manchin.

A last tidbit: you would ask… what is the CEO of Biogen paid? The answer:

For the second year in a row, Biogen CEO Michel Vounatsos has nabbed his highest-ever compensation, earning a grand total of $18.7 million, according to a recent securities filing.

Vounatsos' 2020 earnings represent a 2.7% increase over the previous year's salary, which was in turn a 12% increase from 2018. His total compensation combines his base salary, stock awards and other financial compensation.

The median Biogen employee's pay, meanwhile, dropped slightly, to $155,378 — one-120th of what Vounatsos made. [emphasis added—well, the entire part deserved emphasis because it hs gross riddled throughout]

To sum up and reiterate where I started—this is a classic story of the political corruption that feeds a corrosive economic system.

SHORT TAKES

BLACK UNEMPLOYMENT IS A LOT WORSE THAN YOU THINK

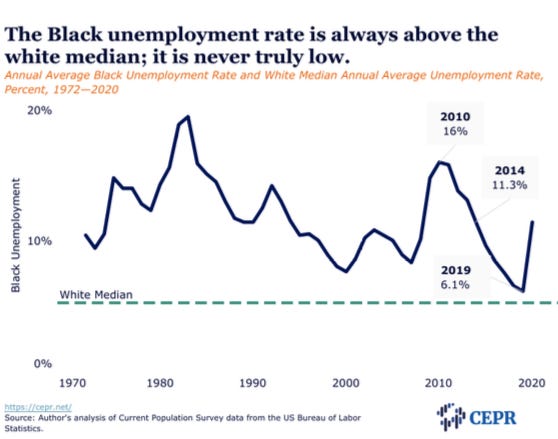

Last week, when the unemployment figures came out, I mused out there on social media that, although still unacceptably high compared to white workers, Black unemployment fell by 1.2 percentage points to 6.7 percent—and per my friend and colleague economist Dean Baker, it’s a level “not reached following the Great Recession until March 2018 and never prior to that time.”

In fact, it’s unacceptably high—and that’s a deep, historic, cancer that goes back to slavery. Most of my readers know this, I reckon. But, we now have a deeper look into how bad the jobs crisis has been for a long time via a report called “The Jobs Crisis for Black Men is a Lot Worse Than You Think” by Algernon Austin, Director of Race and Economic Justice for the Center for Economic and Policy Research (where Dean Baker does his great work).

I’m just going to share the executive summary and a few key graphs:

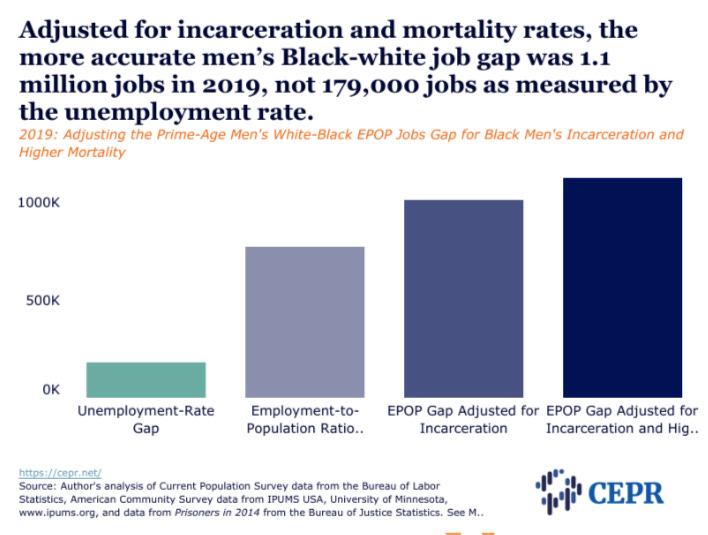

The problem of joblessness for Black men is on average three times worse than most people think it is. We typically assess joblessness based on the unemployment rate, but prime-age (ages 25 to 54) Black men’s employment-to-population ratio (EPOP) lags the EPOPs of prime-age white, Latinx, and Asian men by over ten percentage points. Among prime-age men, Black men’s EPOP is an outlier.

The white-Black EPOP jobs gap is about three times the unemployment rate jobs gap during a period of moderately high unemployment. When we use the unemployment rate to understand joblessness for Black men, we grossly underestimate the problem, the harm it causes to Black communities, and the need for bold policy interventions. If we could close the white-Black EPOP jobs gap, we could add about $30 billion annually to Black communities and make a significant reduction in Black poverty.

This report calculates the white-Black unemployment rate and EPOP jobs gaps during periods of “low,” “moderate,” and “high” Black unemployment. Using 2014 as the year for “moderate” unemployment, the analysis finds that for Black men to have a similar EPOP to white, Latinx, and Asian men would have required 947,000 jobs, 2.8 times the number to close the unemployment rate gap.

A problem with the official labor market statistics is that they do not include the Black men who are incarcerated or allow us to evaluate the economic impact of the higher mortality rate of Black men. Prime-age Black men who are incarcerated or deceased still have children, family members, and partners who, under different circumstances, could benefit from their financial support. When one takes into account the incarceration and mortality rates of Black men, the EPOP jobs gap jumps to four times the unemployment rate jobs gap, and the income deficit approaches $50 billion a year.

Addressing the prime-age men’s white-Black EPOP jobs gap is one important step in building up the economic health of Black communities. Among the other steps are reducing the high incarceration and mortality rates of Black men. [emphasis added]

These graphs tell the story quite well.

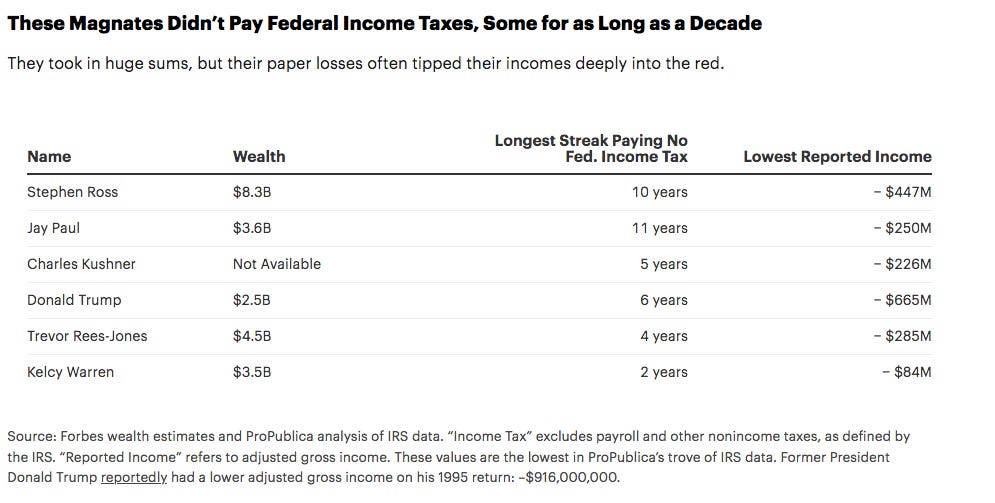

The Real Estate and Oil Scammers

ProPublica, a national treasure where real journalists ply their trade (“Real” meaning people who actually read, don’t traffic in gossip and are not simply mouthpieces for elites), has a really terrific new study looking at yet another tax scam that allows real estate and oil tycoons to dodge paying taxes.

Sadly, as we too often learn, most of these scams are legal corruption—“legal” because the tax loopholes allowing this scam are part of the tax code passed, over many years by politicians (and here’s the *corruption* piece) who pocket campaign contributions and, then, do the business of pushing through laws that enrich a few, at the expense of everyone else.

The report leads with the example of real estate billionaire Stephen Ross:

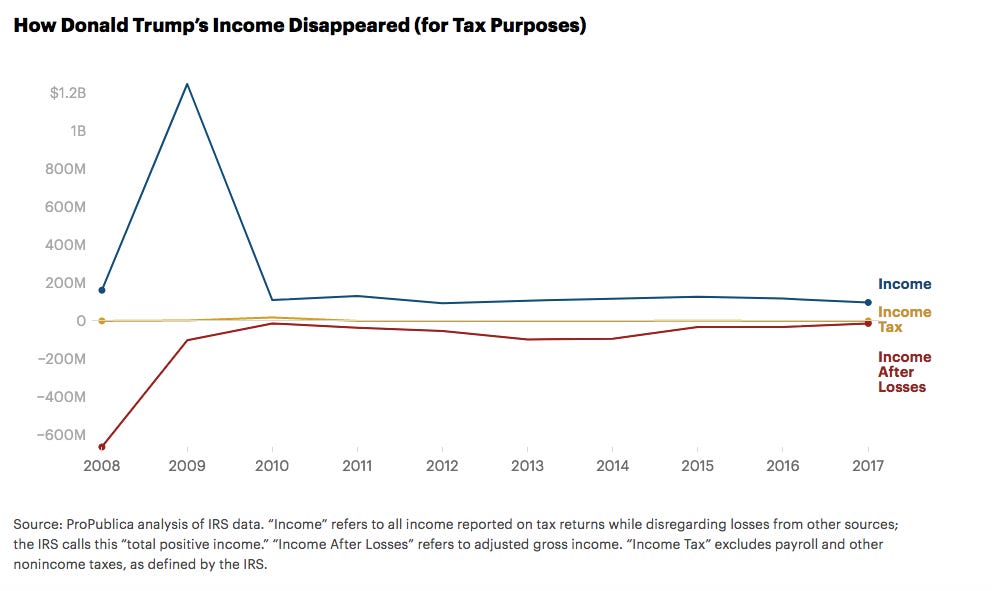

He is among a subset of the ultrarich who take advantage of owning businesses that generate enormous tax deductions that then flow through to their personal tax returns. Many of them are in commercial real estate or oil and gas, industries that have been granted unusual advantages in the American tax code, which allow the ultrawealthy to take tax losses even on profitable enterprises. Manhattan apartment towers that are soaring in value can be turned into sinkholes for tax purposes. A massively profitable natural gas pipeline company can churn out Texas-sized write-offs for its billionaire owner.

By being able to generate losses — effectively, by being the biggest losers — these Americans are the most effective income-tax avoiders among the ultrawealthy, ProPublica’s analysis of tax data found. While ProPublica has shown that some of the country’s absolute wealthiest people, including Jeff Bezos, Elon Musk and Michael Bloomberg, occasionally sidestep federal income tax entirely, this group does it year in and year out.

A couple of charts from the study should feed your appetite.

Go over there and read the whole thing.

Gas Prices In Perspective

I am certainly sympathetic to the people who find themselves paying more to fill up the gas tank. But, let’s also keep in mind this point—relative to the rest of the developed economies in the world, Americans have paid massively subsidized *low* gasoline prices for decades, a bad habit that (a) encouraged people to buy entirely unnecessary gas-guzzling SUVs, Hummers, RVs and the like and (b) slowed down the development of fuel efficient cars and (c) undermined attempts to put in place fuel efficiency standards that would last and not be political footballs depending on who was in power and (d) supported the fossil fuel-oriented U.S. foreign policy that would encourage war and, finally, obviously, (e) fed the climate change crisis.

You want numbers? The recent average price for a gallon of gas:

United Kingdom: $5.79

Germany: $5.57

France: $5.54

U.S.: $3.37

Politically, of course, you could never say, “higher gas prices is a good thing” and the scandal here is the massive profits being reaped by oil companies and authoritarian ruthless governments like Saudi Arabia’s gang. But, it is a fact that gas prices here have been artifically low for decades—with bad results.

Cold War Heats Up On Two Sides Of The Globe

I’ve been noting—and writing about—the new Cold War for awhile. For today, I’m just noting a few quick, new additions to this drumbeat—which is gathering pace and, slowly but surely, will become a hardened mantra with dire outcomes almost inevitable, if history is any guide.

We now have added the boycott of the Olympics in China by U.S. officialdom (though athletes can participate—for the simple reason that corporations and advertisers have a lot of coin riding on that ridiculous spectacle), the heated propaganda around Russia’s intentions towards Ukraine and the red-baiting of a government nominee—to mention just a few examples.

I have always found it useful to try to view any conflict through the eyes of those being targeted—either with real force or by propaganda. I think you can have two views that live in the same space:

View #1: China and Russia are authoritarian regimes. In particular, there should be a relentless focus on the enslavement of hundreds of thousands of Uyghurs (which I explored in July 2020 in this podcast).

View #2: The U.S. foreign policy establishment, egged on by defense contractors who want to keep making weapons and huge profits, is aching to gin up new conflicts and wars.

Both views above are easily understandable as an interlocking duality if we grasp a unifying thread: at the end of the day, this is about money. The three countries have one thing in common—service to global capitalism and who will get the bigger slice of the pie by attracting corporate business.

The Uyghurs? They are imprisoned in labor camps serving the supply chains of at least 83 well-known global brands in the technology, clothing and automotive sectors, including Apple, BMW, Gap, Huawei, Nike, Samsung, Sony and Volkswagen.

A willing participant in the shallow discussion is, as usual, the traditional media. One of the most reactionary bits you could find just last week was the CNN show “China's Iron Fist: Xi Jinping and the Stakes for America” hosted by Fareed Zakaria. I tuned in for a bit—and it was a shallow piece of rubbish, complete with your basic ominous, scary sound track. Propaganda on steroids.

Just this week, red-baiting reached into the relatively low-visibility debate over a government nominee when Saule Omarova, who had been nominated to be comptroller of the currency, a position that oversees banking, withdrew from consideration. To be clear, she was no radical—saying, as she did in some previous observations as an academic, that the banking industry is an “asshole” industry is not especially earthshaking.

What really led to her withdrawing was, to be accurate, a two-pronged attack on her: her critique of banks fueled, to our topic here, a disgraceful red-baiting assault by a handful of Republicans who used her former Soviet Union birthplace to accuse her, explicitly, of being a communist—but it was also an attack that was aided by a handful of banking industry shills in the Democratic Party (Senators Jon Tester, Mark Warner, Kyrsten Sinema, Mark Kelly and John Hickenlooper) who pocket campaign cash from banks and, thus, opposed her nomination. An appropriate bookend to the general point here: the red-baiting, and the new Cold War, should always be viewed through the lens of money.

Speaking of money, the “wrapper” for all of this new-found Cold War drumbreat is an obscenely large Pentagon budget passed by the House just two days ago with resounding embraces from both parties by a 363-70 margin, that included 169 Democrats and 194 Republicans; it’s likely to get the same big hug by the Senate. That’s $25 billion more than Joe Biden, no peacenik, proposed. Inside that bill are billions that are explicitly, openly, directed at amping up the hostility towards China.

War might be the only true, unshakeable bi-partisan policy left.

If you liked this post from Working Life Newsletter, why not share it?