|

The Two-Fisted Corporate Stock Scam

SHORT TAKES: Pigs Fly!!!--Bank of America Promises $25-An-Hour Minimum Wage; COVID19 Food and Housing Insecurity; Bitcoin Is A Climate Change Disaster; A Pentagon Audit *Might* Happen

| Jonathan Tasini | May 20 |

LONG TAKE

[By the way…please do comment here!!! And share this week’s issue with just ***one*** friend today!]

Around Tax Day, I always take a look at the ways in which the very wealthy use the tax system to rip all of us off. There is so much fodder for this right now, so, for brevity sake, I’m going to spread this topic out over a few issues of the newsletter.

Let’s start our journey today with the scam of the twin, inter-related manipulations embedded in Stock Options and Stock Buy-Backs. I think it’s not at all obvious to lots of folks how these two concepts work hand-in-glove, every day, shifting over time billions of dollars to a few while impoverishing millions of workers and costing countless jobs. You will see the dynamic summed up easily in a sec at the end of this explanation. But, let’s first review how each of the two manipulations work.

I have pointed out over a long time that, while CEOs get a very hefty regular paycheck far larger than any average person could dream of earning, the real money for CEOs is tucked away in their benefits—especially stock options, which can give CEOs tens of millions of dollars in compensation, money they pocket even when they invariably do a terrible job. For the readers who are a little hazy on this, here’s how stock options work:

A company says “hey, genius CEO, we will give you one million stock options to buy the stock anytime in the next ten years at today’s price of [I’m just picking a random price] $10-a-share.” Over that decade, unless the company goes bankrupt, it’s a fairly good guess the shares of the company will increase in value, sometimes by a lot. So, say, the CEO decides that, in year 7, he wants to exercise those options at the going price of $15-a share. He sells his stock options on the open market, essentially pays the company the $10 million dollars for the option price (called the “strike price”) that was set seven years prior, and, then, pockets the additional $5 million as a tidy profit—for doing no more work than what his regular paycheck should cover, in a normal world.

There’s another scam the company plays on us with stock options. When it grants the stock options, it logs the options cost as an internal accounting expense at, more or less, the strike price—to keep the hit on the overall bottom line of the company as low as possible so investors and analysts see a bigger profit overall. BUT—when the CEO actually exercises the options, the company very often, then, takes the dollar amount of the FULLY EXERCISED OPTION and deducts THAT from its tax liability that it reports to the IRS—presto, a nice tax break.

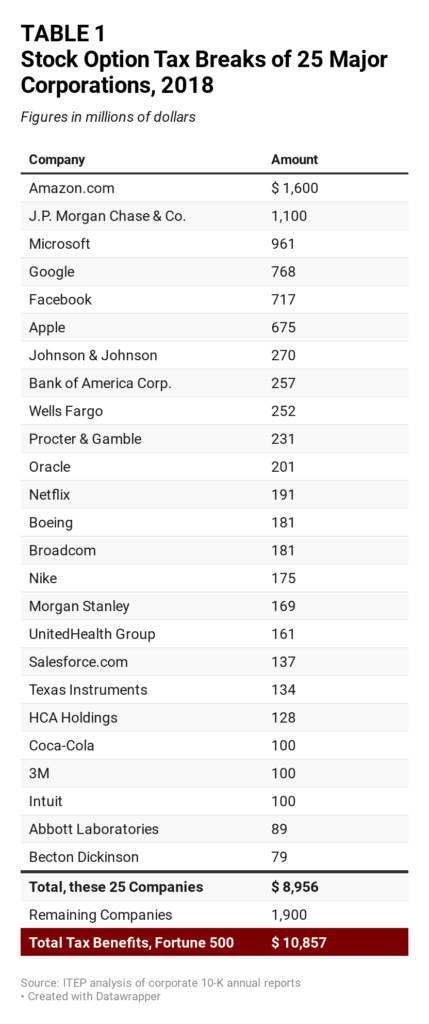

And, in fact, that has cost the Treasury—meaning, you and me and every regular taxpayer—billions of dollars. Just look at the 2018 cost to the tune of more than $10 billion just among Fortune 500 companies, courtesy of the Institute on Taxation and Economic Policy:

This is nothing new and has a long history. From ITEP, looking at a five-year period, 2004-2009:

The IRS determined that profitable U.S. corporations reduced their taxes by billions of dollars each year during the covered period by claiming stock option tax deductions far in excess of the stock option expenses shown on their books. The IRS data disclosed that the total amount of excess stock option tax deductions taken per year by the corporations varied during the covered time period from a low of $12 billion to a high of $61 billion [emphasis added].

And the scam continues this very tax year. In the current tax year, Zoom “reduced its worldwide income taxes by $300 million in 2020 using stock-based compensation” and Amazon, despite having record profits in 2020 largely feeding off the pandemic, dodged $2.3 billion in taxes including saving “$1.8 billion using tax breaks for stock options.”

Now, the above scam, then, explains a lot about STOCK BUYBACKS. A company decides to buy back its shares for one reason only: to try to manipulate and boost the share price of the company—which effectively mostly benefits (see above) the CEO and his cronies who reap huge fortunes.

This may seem obvious but it needs to be underscored: Buying back a company’s shares on the secondary market—i.e., the way you and I might buy a share—does not bring in any new capital to a company and does not help the company improve a product or help a company become more competitive. The opposite—When a company buys backs its own shares, it is taking money out of the corporate bank account to do so—money that is, then, not around to pay for say workers’ wage increases or, heck, even productive investment in machinery or technology.

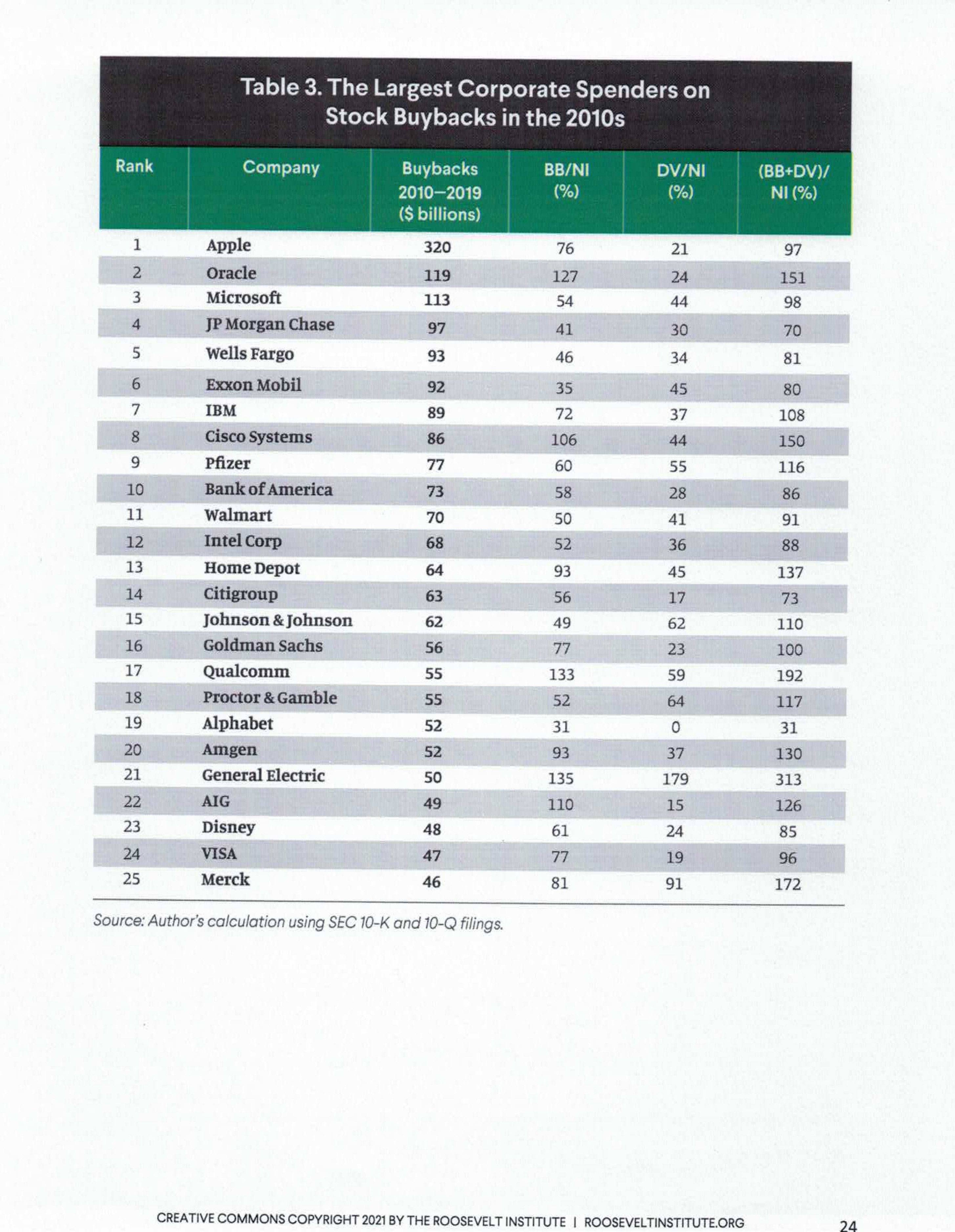

This new, hot-off-the-presses analysis by The Roosevelt Institute, “Regulating Stock Buybacks: The $6.3 Trillion Question” tells a concise story:

Spending on stock buybacks occurred during the past decade both in sectors where underinvestment in actual productive resources led to under- preparedness in critical medical supplies as the pandemic surged, and in sectors such as retail and food services where the unexpected decline in economic activity due to public health measures led to layoffs of millions of the US’s most vulnerable workers.

Translation: CEOs were enriching themselves, year after year, and that would cost peoples’ lives, health and jobs during the pandemic. I know, you are shocked, shocked, shocked to hear that.

The Roosevelt Institute report has this tidy graph to show the scale of stock buybacks over a decade:

The careful reader will note some of the overlap between companies using both the stock option tax deduction scam and the share buyback gambit.

Buybacks are now breaking records, with $504 billion announced so far in 2021—the highest level in 22 years. You might ask why the big leap? The answer explains how bad stock buybacks are for a company’s health: companies held back from buying back shares during the pandemic in order to have a cash cushion to blunt the hit from the economic crisis; meaning, there was a recognition that stock buybacks drain badly needed cash from a company and, in a pandemic, that cash might be needed. Right now, CEOs are feeling like the pandemic crisis is abating for them (let’s be clear “the pandemic crisis” for a CEO, who whiled away the pandemic time in a mansion or lavish penthouse somwehere, was only every about keeping his multi-million paying job) and there’s a lot of pent up demand for buy-backs driven by the desire of a CEO and top executives to pocket more cash—but virtually no concern about the long-term crisis facing workers who can’t make ends meet. That extra corporate cash could be used to pay workers a decent wage…except CEOs don’t really care about anything but their own survival.

So, to sum up:

Stock options take millions of dollars out of the corporate piggy bank and enrich the CEO and top executives—and we, taxpayers, pay for those stock options because companies essentially rob the U.S. Treasury by claiming questionable tax breaks when CEOs exercise the stock options;

That huge pile of cash devoted to stock options, then, is not there to spread around for the wages of rank-and-file workers, or even to make long-term wise investments.

The stock buy backs are engineered to boost a stock price so CEOs get richer, but, again, money is diverted from either wages for the people who actually make the company work and/or productive investment in a company that might set it up for long-term success

SHORT TAKES

I’m not a fan of the leadership of banks. And Bank of America would be at the top of my list of corrupt banks—in a long list of sleazy behavior, you can just point to its deal to pay $16.65 BILLION in 2014 to settle fraud charges as part of the mortgage scam that sparked the 2009 economic collapse.

That said, the bank has now pledged to raise its hourly pay to $25-an-hour by 2025, and it’s going to mandate that its vendors pay $15-an-hour at a minimum—which is a strong move considering that (a) most state minimum wages, even in the more progressive states, are only going to match by 2025 the national meme of $15-an-hour and (b) as I’ve pointed out for a number of years, the true federal national minimum wage, if the minimum wage reflected productivity gains over the past 40 years, should be at $22-an-hour.

So, I applaud this move—but with a very light clap because Bank of America is doing this not because of some moral awakening. It’s a simple calculation of a company understanding that it better start paying livable wages to attract the people it wants.

By now, I think it’s an accepted fact that there was a very unequal way in which the COVID-19 pandemic hit people, from the actual medical effects to economic devastation (for example, the ability to work at home/not work at home which, in turn, made a big difference if a person was exposed to the virus or not).

The folks at the Center for Economic and Policy Research looked at the question of food and housing insecurity especially focusing on the racial disparities. They found:

Thirty-five percent of Black and Hispanic households reported housing insecurity compared to 14 percent of white households.

Households with children reported higher levels of housing and food hardship than the overall group of respondents.

Single or unmarried parents (regardless of the presence of other adults in the household) reported the highest levels of both food and housing insecurity over the survey period, while married adults without children in their household had the lowest levels.

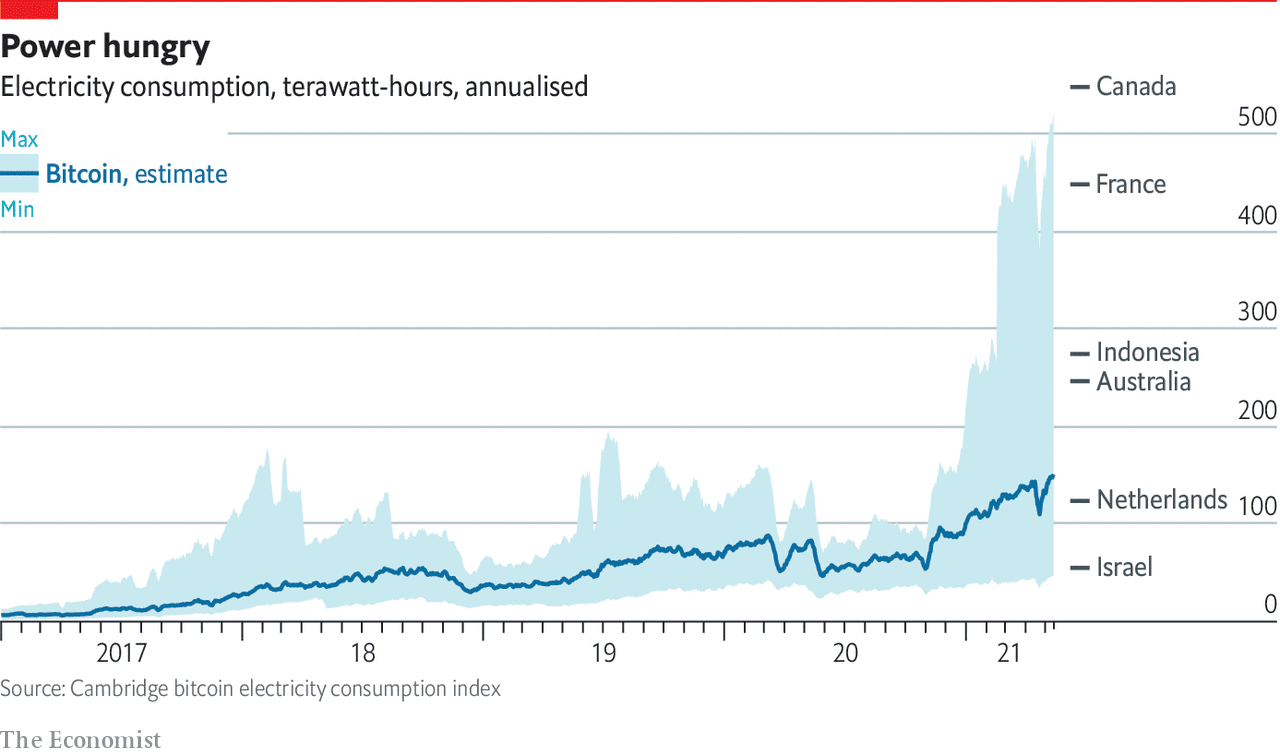

I’m not really a stock market guy so this whole bitcoin craze strikes me as bordering on the insane. But, if you are a bitcoin fan, know this: it has huge environmental costs—the energy needed for bitcoin “mining” could eventually equal the amount of energy consumed by all other data centers combined. Per The Economist:

Bitcoin’s intensive use of energy comes down to the way it is put into circulation. Creating new coins and verifying transactions requires using computers to carry out complex calculations, a process called “mining”. Crypto miners compete to register the latest “block” of bitcoin transactions by solving cryptographic puzzles, an extremely energy-intensive process. As more bitcoins are produced, the difficulty of these puzzles increases to keep the rate of block production stable. This in turn demands more powerful computers using more energy.

The Economist has a graph for that:

Last week, my lead item was an extensive look at the scam of Pentagon spending—spending enabled by a bi-partisan embrace of American Exceptionalism, American global superiority, the revolving door of former government officials selling their wares to the highest defense contractor bidder and defense contractor corruption in the form of lobbying and political contributions.

Yesterday, a very, very, very tiny murmur bubbled up that *might* address, at least, a smidgen of this colossal waste of money. The Pentagon has never had an independent audit—over the past two decades, trillions of dollars have gone unaccounted for. Yeah, right, but, at the same time, you can’t go a day without hearing some Congressional fool rant about spending on social programs like Medicare (as an aside, Medicare, unlike the Pentagon, is one of the most efficient programs, administratively, in the nation’s history).

So, Bernie Sanders (I-Vt.), Chuck Grassley (R-Iowa), Ron Wyden (D-Ore.), and Mike Lee (R-Utah) introduced the Audit the Pentagon Act of 2021, which, per Sanders, “would require the Department of Defense (DOD) to finally pass a full independent audit beginning in fiscal year 2022. Under the bill, each branch of the military and part of the DOD that fails to obtain a clean audit opinion would return one percent of its budget to the Treasury.”

A little more per Sanders explains the scale of the scandal:

The Defense Department remains the only federal agency in the United States that has been unable to pass an independent audit, despite the fact that the Pentagon consumes more than half of the nation’s discretionary budget and controls assets in excess of $3.1 trillion, or roughly 78 percent of the entire federal government. Federal agencies have also been mandated by Congress to comply with annual audits by the Government Accountability Office since 1990, a requirement continually unfulfilled largely due to the DOD’s inability to pass an audit.

In 2011, the Commission on Wartime Contracting in Iraq and Afghanistan concluded that $31-60 billion spent in Iraq and Afghanistan had been lost to fraud and waste. In 2015, the Special Inspector General for Afghanistan Reconstruction reported that the Pentagon could not account for $45 billion in funding for reconstruction projects. In 2018, an audit conducted by Ernst & Young for the Defense Logistics Agency found that the Pentagon could not properly account for some $800 million in construction projects.

Currently, the U.S. spends more on our nation’s military than the next twelve countries combined and about half of the Pentagon’s budget goes directly into the hands of private contractors, not our troops. Meanwhile, half of our people are struggling paycheck to paycheck, over 40 million Americans are living in poverty, and over 500,000 Americans are homeless including roughly 40,000 veterans.

Congress has appropriated so much money for the Defense Department that the Pentagon does not know what to do with it. According to the GAO, between 2013 and 2018 the Pentagon returned more than $80 billion in funding back to the Treasury. And, over the past two decades, virtually every major defense contractor in the U.S. has paid billions of dollars in fines and settlements for misconduct and fraud – all while making huge profits on those government contracts.

To be sure, this is a very tiny step: it does not grapple with the immorality of U.S. foreign policy, and the Pentagon’s role as global super-cop. But, it’s a step worth taking to begin the exposing of where a mountain of money is spent.

If you liked this post from Working Life Newsletter, why not share it?