|

There Is No Such Thing As "Low Skills"

SHORT TAKES: Capitalism and Economic Violence; Starbucks Skepticism In Numbers; Europe Shrugs on Inflation

| Jonathan Tasini | Jan 21 |

LONG TAKE

For your consideration: another chapter in a theme I wrote about in the last issue: the disconnect between reality and propaganda when it comes to trying to link pieces of information to get a clear understanding of what the hell is going on in the economy.

Today, a constant source of irritation to me: the refrain about “low-skilled” workers. It is a pretty universal phrase, used across the political and media spectrum without much thought—and it reflects both elitism and class warfare at work.

When you think about who is classified as “low-skilled” in the chatter, it’s usually service workers and plenty of blue-collar workers.

Who defines what “low-skilled” is? Well, a bunch of academics and wonks who presumably consider themselves “high-skilled” because they went to college and got some piece of paper conferring on them some higher status, at least in their own minds. This is the Robert Reich way of thinking—as in his foolish, and quite dangerous, “theory” (now discredited and mocked) that the future belonged to everyone who would become a “symbolic analyst”.

And what is the real motivation behind defining a certain class of workers as “low skilled”?

It should be obvious: Pay. Them. Less.

If a worker is “low-skilled” in today’s economy, it’s a justification to pay that person a poverty-level wage. The argument, among some rapacious folks, to keep the federal hourly minimum wage—stuck at $7.25-an-hour since 2009—at its poverty level is that it is the proper pay for “low-skilled” workers, especially folks laboring in the retail sector.

People have different skills, not “low skills”. I may have a college degree but, trust me, you don’t want me handling basic tools or trying to fix something or collecting your refuse.

And consider this short thought exercise: would society function without people who have different skills that some refer to as “Low-skilled”? The answer is no.

SHORT TAKES

Capitalism and Economic Violence

It’s kind of a familiar by now to gauge, with numbers, the absolute greed “free market” capitalism inspires. This is not some academic exercise or just a bunch of statistics—it’s a picture of violence that takes place every day in the economy, as a few obscenely rich people batter hundreds of millions of people, either because of the products that enrich a few and/or because of the utter immorality that spawns billionaires while vast numbers of human being are on the brink of starvation every single day.

Oxfam has its annual reported, this year entitled “Inequality Kills.”

Per Oxfam:

There are 740 billionaires with wealth totaling $5.1 trillion. Their wealth has increased by $1.9 billion since March 2020, the beginning of the pandemic. The five richest people in the United States are:

Elon Musk, $297 billion

Jeff Bezos, $201.7 billion

Bill Gates, $136.5 billion

Larry Ellison, $124.8 billion

Larry Page, $121.4 billion

Your nuggets to pass along:

The wealth of the 10 richest men has doubled, while the incomes of 99% of humanity are worse off, because of COVID-19.

The 10 richest men in the world own more than the bottom 3.1 billion people. The richest billionaire, Elon Musk, owns more wealth than the bottom 40 percent (131 million Americans).

If the 10 richest men spent a million dollars each a day, it would take them 414 years to spend their combined wealth.

If the richest 10 billionaires sat on top of their combined wealth piled up in US dollar bills, they would reach almost halfway to the moon

An especially timely reminder:

A 99% windfall tax on the COVID-19 wealth gains of the 10 richest men could pay to make enough vaccines for the entire world and fill financing gaps in climate measures, universal health and social protection, and efforts to address gender- based violence in over 80 countries, while still leaving these men $8bn better off than they were before the pandemic.

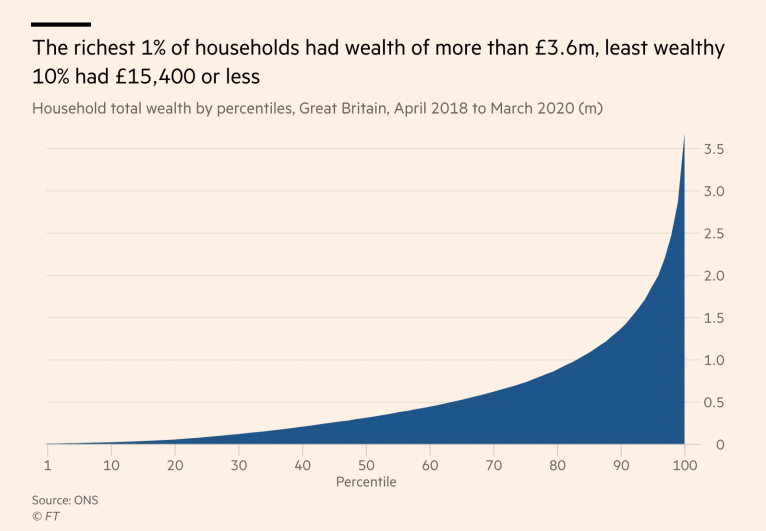

While we are on the topic, a little focus on inequality in the United Kingdom. I’ll spare you the words and use visuals courtesy of the Financial Times:

Starbucks Skepticism In Numbers

A few weeks ago, I made a short observation (see “Short Takes”) about the reality of the Starbucks union organizing efforts. It’s terrific when any workers win a union representation election given the odds and the intense opposition and fear campaign virtually every company uses. We can only applaud the guts, commitment and hard work of every organizing committee.

And, yet, I was—and still am—skeptical when I hear people call the efforts a “watershed” moment for labor. If by “watershed” one means a time of an important change.

And, alas, I have the numbers to back this up. Here is the recently released data from the Bureau of Labor Statistics:

In 2021, the number of wage and salary workers belonging to unions continued to decline (-241,000) to 14.0 million, and the percent who were members of unions--the union membership rate--was 10.3 percent, the U.S. Bureau of Labor Statistics reported today. The rate is down from 10.8 percent in 2020--when the rate increased due to a disproportionately large decline in the total number of nonunion workers compared with the decline in the number of union members. The 2021 unionization rate is the same as the 2019 rate of 10.3 percent. In 1983, the first year for which comparable union data are available, the union membership rate was 20.1 percent and there were 17.7 million union workers.[emphasis added]

The point here is: if the “watershed” moment is anchored in organizing victories of twenty to thirty people in individual Starbucks locations—or, for that matter, organizing similar size groups of workers in other places—there is no hope for gaining back the kind of leverage unions still had in 1983, not to mention even more leverage unions had in the 1960s and 1970s in key sectors of the economy. It’s just math.

The main take-away here should be that absent massive organizing victories—in the tens of thousands in multiple industries in short spans, which can only come with widespread uprisings, backed up by the ability to win elections across large swaths of an industry and, crucially, then, bargain for big numbers at the same time (changes embedded in the Protecting the Right to Organize Act, or PRO Act, which is dead on arrival in the U.S. Senate)—the needle will not move. Which will mean the continued decline of wages for everyone.

Europe Shrugs on Inflation

I’m not some fan boy of Christine Lagarde, the president of the European Central Bank; she, and the Bank (with pressure from especially now-former German Chancellor Angela Merkel), were happy to enforce austerity in the name of balanced budgets.

But, this is a position that the fool Joe Manchin, hand-wringing about the non-existent long term threat of inflation might want to absorb (yes, he’s on the payroll of corporate donors so it’s probably a futile cause:

Christine Lagarde has rejected calls for the European Central Bank to raise interest rates more quickly than planned in response to record inflation, saying it had “every reason not to act as quickly or as ruthlessly” as the US Federal Reserve.

The ECB president warned that raising interest rates too soon risked “putting the brakes on growth” and she told France Inter radio on Thursday that she wanted its monetary policy to act as “a shock absorber” instead.

To be sure, there is disagreement within the ECB on the inflation issue. But, for the time being, sanity is prevailing.

If you liked this post from Working Life Newsletter, why not share it?