|

Inflation and Greed: A Love Story

SHORT TAKES: State Tax Cut Madness; And About That Gas Tax; Your Diet and Land Use

| Jonathan Tasini | Feb 22 |

LONG TAKE

When it comes to inflation, I have been, and still am, in the camp of Team Transitory—that is, that the current inflation is largely a factor of pandemic-related distortions in the global economy (especially, the mucking up of supply chains) and will pretty much be a non-factor by the Fall or end of 2022 (assuming, of course, that we don’t descend into a third year of big new waves of unknown-today COVID variants)

But, let’s understand a really key point here: inflation and greed are deeply tied together. If the super-wealthy, CEOs and the rest of the wealthy elites were not so intent on lining their own pockets at the expense of everyone else, we wouldn’t even be talking about inflation as a problem.

Three main points to illustrate the love story between inflation and greed.

First, the just-mentioned “supply chains”. Back in October, I wrote about supply chains, pointing out that supply chains don’t just happen as if ordained by nature. We should not just nod our heads in agreement when we hear “supply chain delays are causing inflation” without understanding what supply chains are all about and how they came to be—and that global supply chains don’t have to exist, on a planet with ethical standards.

The entire global expansion of supply chains was a conscious decision by free-market politicians and corporate leaders. The freezing of the “supply chain” had a lot to do with poverty and exploitation. Think again about where the links to the “supply chain” lead—to the thousands of factories in poor countries that had to shut down because of the COVID-19 pandemic.

So, when you hear a bunch of bullshit that wage increases are part of what is contributing to inflation, it’s the opposite (and I will come to more on wages in a sec): poverty/slave wages are the anchor for the supply chain model. Put another way, if corporations were forced to pay higher wages—largely through broad unionzation—plenty of the stuff made in factories in corners of the world where people are paid pennies in horrendous conditions would be made closer to where consumers lived. Which would, aside from making the supply chain crisis non-exsistent, also mean better jobs.

Second, part of how regular people experience inflation is, obviously, higher prices. You know who isn’t suffering from inflation? Corporations that are reaping huge profits and rich people, especially CEOs, who make mountains of money when corporations make profits and drive the stock market up (and, yes, some stocks are high at companies losing money—but that’s another story).

Here are a few examples.

The gas pump, right? It’s costing more to fill up the tank.

And so this might, ummm, be interesting, via the Financial Times (subscription):

Western energy majors are on course to buy back shares at near-record levels this year as soaring oil and gas prices enable them to deliver bumper profits and boost returns for investors.

The seven supermajors — including BP, Shell, ExxonMobil and Chevron — are poised to return $38bn to shareholders through buyback programmes this year, according to data from Bernstein Research. Investment bank RBC Capital Markets put the total figure higher, at $41bn.

That would be almost double the $21bn in buybacks completed in 2014 — when oil last traded above $100 a barrel — and the biggest total since 2008.

And:

On top of the share purchases, roughly $50bn is expected to be returned to shareholders via dividends, RBC’s Borkhataria added, noting that total shareholder returns from the supermajors could move higher if oil prices climbed further. [emphasis added]

So, somewhere in the neighborhood of $90 billion is going into essentially rewarding elites and investors—money coming out of the pockets of average people who pay higher prices to fill up their cars (I do want to make one side point: I’m truly sympathetic to the strain people feel in the U.S. when gasoline prices go up but the truth is gas here is subsidized and far lower in price than virtually every developed country in Europe—see SHORT TAKES on the gas tax holiday).

And the dudes running the oil companies? In 2020 (figures for 2021 will be out once we get corporate annual reports in the coming weeks):

Exxon Mobil CEO Darren Woods, after receiving a 25% pay raise in 2019 to bring his compensation up to $23.5 million, made another $15.6 million in 2020 (the lower figure in 2020 was about non-pay compensation);

Chevron CEO Michael Wirth socked away $29 million (and four other top executives made a total of $36 million); and

Shell CEO Ben van Beurden made $7 million in 2020.

It wasn’t just oil companies. If you look at supermarkets—take Safeway and Albertsons—all their revenues are going up, particularly as people seem less concerned about in-store pandemic-era buying. Amazon had $469 billion in revenues in 2021. Apple made record sales in the fourth quarter of 2021—$124 billion—and basically made about one billion every day of the year (and CEO Tim Cook’s salary was a tidy $98 million—don’t worry that it seems “low”… he’s a billionaire because of stock options).

You just go down the list and everywhere you look CEOs are reaping huge pay days and companies are racking up big numbers in sales.

Now… of course, if this was a moral world, there could be a view that profitable companies could keep prices down—and even cut prices—at the expense of CEO pay and stock prices. HAHAHAHAHAHAHA…

But, at least, let’s understand that price hikes are about greed and profits and keeping a stock price high because that’s how CEOs accumulate most of their wealth.

Third, the vast majority of people freak about inflation because wages are too low. Low wages is the built-in feature of the free market economy that just makes things worse—for worker, not for the Waltons of Wal-Mart or Jeff Bezos whose riches are dependent on low wages.

If you already are working a minimum wage job, or even a job that pays above the minimum wage, and you still can’t pay the rent, or you’ve got a big student debt bill, or your kid has an on-going medical expense not covered by your pathetic insurance plan, then, inflation becomes a big deal—a financial calamity in the making.

Put another way, if unions were strong, if we had a single-payer national medical system, if we cancelled all student debt, if people had (like most advanced countries) paid child care and family leave, inflation would be far less of an issue.

SHORT TAKES

State Tax Cut Madness

The history of this era will be replete with endless stories of dumb choices driven by blind ideology and stupidity.

Today’s example, Via our friends at the Institute for Taxation and Economic Policy:

Most state budgets are flush with cash due to billions in federal aid and a rebounding economy, positioning state policymakers to make transformative investments in programs, e.g. healthcare, education and infrastructure, that will help communities rebound from the ongoing pandemic. Unfortunately, most state legislatures are instead opting for premature, myopic tax cuts that will inevitably widen racial inequities and erode public services that are still reeling from cuts due to the Great Recession.

It’s a competition.

In Arkansas, the legislature undertook major reforms to their tax system, including dropping the top income tax rate from 5.9 percent to 4.9 percent on income over $37,200. Lawmakers also created a $60 non-refundable credit for low-income filers. While supporters of the tax bills claimed this credit ensured that both low and high-income Arkansans benefited from the tax changes, it is clear that wealthy Arkansans are the real winners.

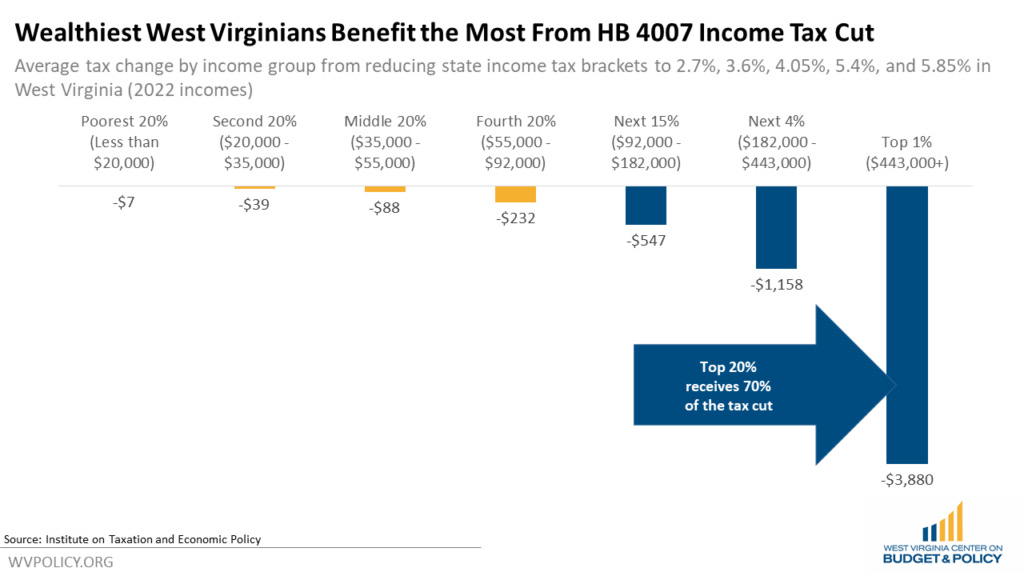

And West Virginia—breeding ground for the Manchin-type fools—wants to not only cut taxes, it wants to eliminate the personal income tax. From the folks at the West Virginia Center on Budget and Policy:

Last week the West Virginia Legislature introduced a bill to cut and eventually eliminate the state’s personal income tax. This week, the House Finance Committee voted to advance that bill to the House floor with no discussion or questions asked. Like previous attempts to eliminate the state’s income tax, HB 4007 would lead to major revenue losses for the state, while giving most of the tax cuts to high income West Virginians.

The personal income tax is the state’s largest source of tax revenue, providing the state with $2.25 billion in FY 2021 and accounting for 45 percent of the state’s general revenue fund. The income tax is also the state’s fairest source of revenue. West Virginia has progressive income tax rates, meaning that it is structured such that higher-income residents pay a larger share of their income in personal income taxes compared to low- and middle-income residents. This structure helps ensure that wealthier taxpayers pay their fair share, allows for lower rates on low- and middle-income families, and provides a counterweight to more regressive taxes, such as the sales tax. [emphasis added]

Who will benefit? Joe Manchin’s donors of course—

The idiocy of state tax cuts is mind-boggling but it is a window into the shallowness of elected officials in every corner of the country. Average tax payers will get pennies back—and they will be the ones who will suffer most from crumbling schools, bad roads and bridges and, in general, a decline in services. Even if these tax cuts make no economic sense, there’s a lot of short term *political* sense here because every two-bit politician can wave “tax cuts!” as a slogan—playing on the fears and anger of average voters, and satisfying rich donors along the way.

Call it the Manchin Political Strategy.

And About That Gas Tax

It’s a popular idea: give people a “break” on inflation by enacting a “holiday” on the federal gas tax. It’s being promoted by Senate Democrats.

And it’s a really bad, bad idea.

Again, as pointed out above in the Long Take on inflation, people are hurting for a variety of reasons. But, the hurt should generate not knee-jerk meaningless political gambits but smart ideas—like passing the currently-dead large infrastructure bill which, among other things, extended the Child Tax Credit that would keep far more money in family budget than a gas tax holiday.

A gas tax holiday is meaningless to the average consumer, as the smart folks at ITEP point out:

The national average gas price is up one dollar from a year ago, driven by global markets recovering from the pandemic and by geopolitical turmoil in Eurasia. Even if Americans trust companies like Exxon and BP to pass on the full savings of the gas tax holiday to consumers, the difference would only be 18.4 cents per gallon. The average driver would save less than $8 a month, according to the most recent statistics from the Federal Highway Administration. Gas prices are not going up because of onerous taxation, and they will not meaningfully go down because of a tax holiday. [Emphasis added]

And it’s a bad idea because, duh, the gas tax goes to fund the Highway Trust Fund which is used to fund transportation infrastructure. Can we all agree that fixing roads and bridges is important enough for every person to skip the $8-a-month savings.

Really dumb.

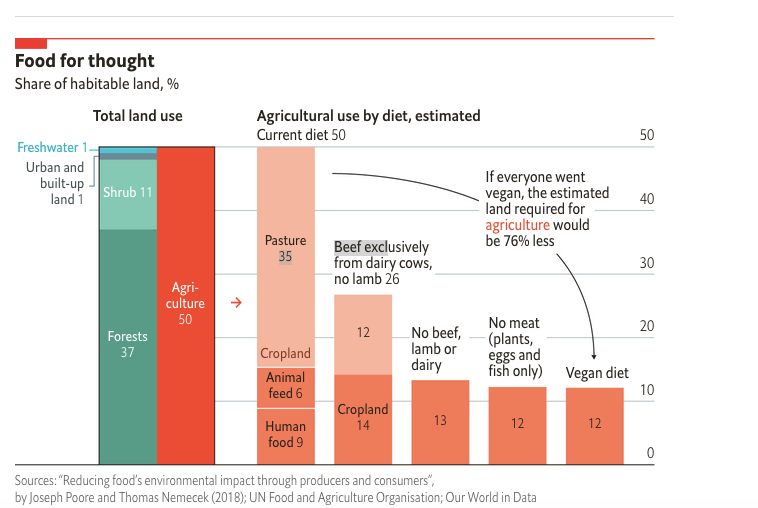

Your Diet and Land Use

I’m not here to try to persuade you that saving the planet means not eating animals, or at least not animals raised in the huge food processing machine. But, just consider this graphic via The Economist which shows how much land is used for raising animals for slaughter versus a no meat/vegan diet. Errrr… food for thought.

If you liked this post from Working Life Newsletter, why not share it?