|

The $3.5 Trillion Big Honker (Hint For Progressives: Focus on Student Debt, Not Whining)

SHORT TAKES: Progressives Have (So Far) Bungled The Pandemic; Manchin Sounds Like A Fool Again; More Robbery By The Rich & Corporations; A Worker Dies--No CEO Jail Time, Just A Cost of Doing Business

| Jonathan Tasini | Aug 12 |

LONG TAKE

The $3.5 Trillion moment: As you are all keen observers and pay attention, you know that the Senate, having dispensed with what I call the “mini” infrastructure bill, is now going to embark on a party-line-only effort to pass a large amount of spending on infrastructure in the neighborhood of $3.5 Trillion (which we will call, for our purposes here, the Big Honker). On a strict party line vote, 50-49, the Senate passed the reconciliation bill instructions framework.

A short digression to explain: what does the budget “framework” do? Basically, led by Senate Budget Chair Bernie Sanders, the bill says to each committee, which is responsible for producing budget line items in the areas of its jurisdiction, “here, do the followings things in your committee and here is the money you have to play with to pay for the priorities we’ve set out”. Then, all that is wrapped back into a bill that will come to the floor of the Senate likely in September. Ah, if it was that simple.

The main purpose today is to go over a bit of this framework as a way to consider what in the hell is the strategy of progressives who are publicly either claiming they will withhold votes in the House for the “mini” infrastructure bill until the Senate passes the Big Honker or maybe sink the Big Honker if progressive goals are not included.

Some factoids:

The Big Honker is a far-reaching effort led by Sanders and allies in Congress. It’s nation-changing. And it would make significant progress in peoples’ lives—and isn’t “progress” part of what “progressives” aim for? Because it’s in the name…

News flash! Medicare For All will not be enacted and it’s a waste of breathe to rant and rave about it.

But, the Finance Committee *is* being directed to plan for “Expanding Medicare to include dental, vision, hearing benefits and lowering the eligibility age”.

And those expansions will be paid for partly by giving authority to Medicare to negotiate drug prices—authority it does not, insanely, currently have.

That is huge for millions of people currently on Medicare and potentially millions more who might become eligible much sooner (lowering the minimum age to 60 is the most talked-about option)—not to mention the changes will save taxpayers a big hunk of money.

The Big Honker will extend guaranteed paid family and medical leave, and pre-K for every three- and four-year old.

On taxes. Sanders says, “At a time of massive income and wealth inequality this is a budget that will end the days of billionaires and large, profitable corporations not paying a nickel in federal income taxes. Yes. We will finally ask the very wealthy and largest corporations to pay their fair share of taxes.”

And the bill has an unwise commitment, one I’ve criticized for some time: taxes won’t be raised on anyone making less than $400,000 a year. That was Biden’s campaign promise—and it’s a mistake to exempt people making health six-figure incomes (say from $200K to $400K) from contributing via taxes to, for example, climate change efforts.

BUT—News flash! The tax rates he is aiming for are not going to make it into the bill.

Vote Math. I’m going to break some obvious bad news—that $3.5 trillion figure will not survive the Senate. The PRO Act—to increase union organizing—is not going to pass in its current form, or even perhaps at all. Progressives don’t have the votes.

So, what exactly is the end game of the hue-and-cry coming from progressives? I’m all for a fight—but where is the strategy? And where is the broad progressive focus?

Here is a modest suggestion: I would offer up full-throated unqualified support for every step the Democratic leadership wants to take—even on the compromises—IN RETURN FOR a full cancellation of the $1.5 trillion in student debt but be open to accepting the $50,000 cancellation per-person proposal put forth by Elizabeth Warren and others.

I wrote about this extensively back in February, calling it a no-brainer.

Why?

Because Joe F-ing Manchin or Kyrsten F-ing Sinema can’t stop it. The Secretary of Education, at the direction of the president, has the legal authority to take that step without a vote in Congress (though I suspect wingnuts will file a raft of legal challenges if it’s done);

It would be a spectacular amount of money-in-the-pockets for a ton of people who progressives want to be speaking to;

It would be a huge benefit to people of color and help narrow a wealth gap with white people;

Progressives, training their fire in one direction, could notch a huge win to take credit for and own that victory in every community (and it would be real, rather than the phony post-election “look at all the endorsed candidates who won” scorecard claims)—and, at the same time, progressives can still be part of a massive injection of real money for people through the Big Honker.

Be smart. Be strategic.

SHORT TAKES

How are COVID-19 and the recent primary in Ohio’s 11th Congressional related?

Simple: the leadership of the progressive movement has utterly bungled a huge organizing opportunity reaching lots of people hit by the pandemic, while wasting plenty of time (and money) on sideshows, especially on one lone election that is inconsequential if you measure it by the threat to peoples’ lives nationwide.

What the contrast above says as well: there is a vast chasm between the progressive organizations and leaders reaping the money and attention from well-heeled and small-dollar donors versus the very small organizations dotting the landscape struggling to just pay the bills.

Here is what I mean: the pandemic has ripped apart the country, killing people in every community, especially communities of color who have been disproportionately hit by the virus. The economic consequences have been devastating.

Progressives (for example, Democratic Socialists of America, of which I am a dues-paying member) could have filled a yawning gap, fanning out AND BEING VISIBLE in every community early on with leaflets outlining masking/social distancing protocols. And, more recently, the same folks could have been all over the mass vaccination efforts, especially in communities with low vax rates.

Instead… thousands of volunteer hours, and millions of dollars, were spent on one Congressional race—at the end of which the candidate of the “establishment” won easily. Not to mention, you’all climate change advocates went and spewed large amounts of carbon for your airline trips or car voyages to travel to Ohio, when you could have been working the pandemic-ridden streets in your own backyard. The hyper focus on the Ohio 11th Democratic primary was cult-like and was especially jarring in comparison to the, at best, muddled chatter about the pandemic.

Meanwhile, to add to this bungling, as the Delta variant was on the march, a huge amount of energy was spent on absolutely pointless Medicare for All rallies. People felt very good about themselves at the rallies—but it was all the same people, the same converted, the usual suspects, saying the same things to miniscule crowds.

No. One. Was. Listening.

It was pointless because why the hell would you hold such rallies when (a) it’s f-ing July, the middle of the summer and (b) Medicare for All is not on the lips of anyone, not even Bernie Sanders and (c) people are entirely freaked out about the new pandemic threats.

Talk. About. Tone. Deaf.

Sigh. I really don’t want to make it my full-time job to comment on every dumb comment by Fifth Columnist Joe Manchin, whose vanity is destined to hurt the Democratic Party (my money, by the way, is squarely on a bet that he switches parties prior to his 2024 re-election campaign because his “bi-partisan” game-playing won’t mean diddly in a state that voted for Trump by an almost 40-point margin; no statewide Democrat will survive the stark partisanship). But, he’s a never-ending source of stupidity and ignorance.

To wit: last week, he wrote a letter to Jerome Powell, chair of the Federal Reserve Board, who must have slapped his head after reading it. After blathering on, Manchin writes this:

With the recession over and our strong economic recovery well underway, I am increasingly alarmed that the Fed continues to inject record amounts of stimulus into our economy by continuing an emergency level of quantitative easing (QE) with asset purchases of $120 billion per month of Treasury securities and mortgage backed securities. The Fed has sustained $120 billion per month in asset purchases since June 2020, despite increasing vaccination rates to combat the virus and additional fiscal stimulus from Congress in the ARP. The record amount of stimulus in the economy has led to the most inflation momentum in 30 years, and our economy has not even fully reopened yet. I am deeply concerned that the continuing stimulus put forth by the Fed, and proposal for additional fiscal stimulus, will lead to our economy overheating and to unavoidable inflation taxes that hard working Americans cannot afford.

Simply put, our monetary and fiscal stimulus response met the moment of crisis when our economy suffered the medical equivalent of a heart attack. But, now it’s time to ensure we don’t over prescribe the patient by further stimulating an already strong recovery and therefore risk our ability to respond to future crises we are sure to face. I urge you and the other members of the Federal Open Market Committee to immediately reassess our nation’s stance of monetary policy and begin to taper your emergency stimulus response. While I appreciate your commitment to maximum employment and stable prices, it is imperative we begin to understand that long term policy responses tailored for an economic depression, like the Great Depression and Great Recession of 2008, may not be what is required for today’s economy and could result in higher than desired inflation if not removed in time.

So, there is so much stupid here I will just make three points:

First, for the love of God, the crisis—what a millionaire like Manchin calls “recession”—is not over. The “strong” recovery is only evident, in any comprehensive way, among the very wealthy who own stocks and real estate, both of which have appreciated throughout the pandemic. There are still plenty of people unemployed, plenty of folks facing economic hardship and we have no idea whether, and how badly, the Delta variant (and future variants on the heels of Delta) will trigger another swoon and shutdowns. That’s why it’s called a *novel* coronavirus—which means we face quite novel, unknown economic challenges. Unless you are clueless, this is no time to declare the crisis over.

Second, there is a very good argument to be made—and it has been made—that the premature ending of support during the 2008-2009 mortgage-driven collapse caused way more pain than people needed to endure, and that the initial Obama rescue package was too timid (yes, partly driven by Republican-Tea Party opposition to anything much larger) and needed to be two to three times larger. There are plenty of people who still have not made it back to where they were in 2008, mainly because so many people burned through their savings, either by spending the meager amounts of cash set aside for an emergency or dipping deeply into an IRA.

Third, the Fed is right—the inflation we read about today is NOT coming in core inflation numbers. Meaning, inflation is not primarily in prices for stuff that will embed itself in the economy over the long-term. The rise in prices is directly tied to shortages—shortages driven by the collapse of the economy and, then, the need for supply chains to re-start and deliver goods. Shortages mean higher prices, for example, for semi-conductor chips. In fact, higher car prices are really driving a big piece of the most recent inflation data (due in part to that shortage of semi-conductors). This will fade.

So, Manchin doesn’t know jack about economics. But, what can you do—the title of “Senator” never came burdened with a requirement that you employ facts and logic, which you quickly learn if, like me, you waste precious hours of your life as a casual observer of Senate floor debates.

Aside: you do remember that Manchin’s morality can be partly seen through the actions of his daughter, Heather MANCHIN Bresch, the former CEO of Mylan, the company that made the live-saving allergy EpiPen—she raised the price of EpiPens almost 500 percent , potentially bankrupting people who needed the EpiPen as a matter of life and death. At the same time, she showered herself with millions of dollars in pay. It’s the Manchin way—be more concerned about elite friends/campaign donors/themselves than average people.

In my practically weekly notations of how the wealthy rob everyone else—because it’s a topic that never ends—here are two additions to your databank—

Your updated corporate tax avoidance rap sheet, from the Institute for Taxation and Economic Policy is vital to keep you up-to-speed on the robbery ESPECIALLY as the question comes before Congress how high to raise the corporate tax rate as part of the $3.5 trillion infrastructure bill (to make the point again—I see no problem debt-financing as much as needed to pass the whole damn thing). But, when you hear the whining about a debt-crisis—which is a non-existent problem—it’s always useful to know:

Thirty-nine profitable corporations in the S&P 500 or Fortune 500 paid no federal income tax from 2018 through 2020, the first three years that the Tax Cuts and Jobs Act (TCJA) was in effect. The 39 corporations were profitable in each of those three years and, as a group, reported to shareholders that they had generated $122 billion in profits during that period. Some of these companies paid federal income taxes in one or two of these years, but their total federal income taxes for the three-year period were either $0 or a negative amount, meaning they received a refund from the IRS for taxes paid in previous years.

A report published by ITEP in April identified 55 corporations that were profitable in 2020 but did not pay federal income taxes for that year.[1] This report expands on that analysis, finding corporate tax avoidance under our current tax laws is a long-term problem that is not unique to any particular year. Several companies appear in both reports because they avoided taxes in both 2020 and over the three-year period, including, for example, Archer Daniels Midland, Booz Allen Hamilton, DISH Network, Duke Energy, FedEx and Salesforce.

Among the 39 corporations that avoided paying federal income taxes over three years, T-Mobile reported the largest profits. It reported $11.5 billion in profits over this time but had a federal income tax liability of negative $80 million, meaning the company received $80 million in tax refunds.

Besides the 39 companies that paid nothing over three years, an additional 73 profitable corporations paid less than half the statutory corporate income tax rate of 21 percent established under TCJA. As a group, these 73 corporations paid an effective federal income tax rate of just 5.3 percent during these three years, meaning they paid federal income taxes equal to just 5.3 percent of their profits.

Among the 73 corporations that paid less than half of the statutory rate are household names such as Amazon, Bank of America, Deere, Domino’s Pizza, Etsy, General Motors, Honeywell, Molson Coors, Motorola, Netflix, Nike, Verizon, Walt Disney, Whirlpool and Xerox—which all paid effective federal income tax rates in the single digits.

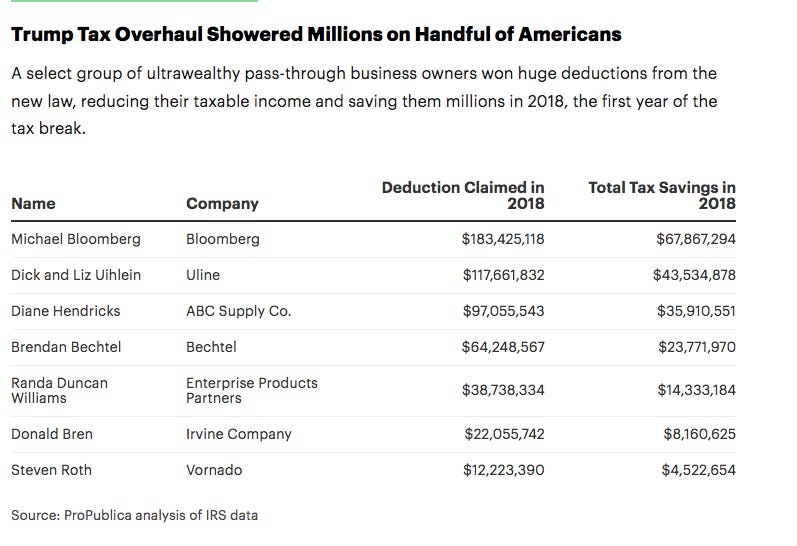

Another fantastic piece of work from Pro Publica on tax dodging dropped yesterday entitled “Secret IRS Files Reveal How Much the Ultrawealthy Gained by Shaping Trump’s “Big, Beautiful Tax Cut”. The key nugget is the huge amounts of money reaped by rich people because of the change in how “pass-through” businesses are treated—profits in “pass through” companies…pass through directly to their owners, not to shareholders, and, then, those profits are taxed not via the corporation but on the individual owner’s returns. The tax change, pitched as a “small business” benefit was nothing of the sort. As you can see from this chart:

This is chilling—and another story how CEOs get away with murder:

Gabbard says a manager noticed 23-year-old Contractor Antonio Ramirez kneeling like he was looking for something. As he got close to Ramirez, he felt a shock and realized Ramirez was being electrocuted.

It happened as Ramirez cleaned an area called “The Hot Room.”

Medical workers transported him to a Perry Hospital, but he was pronounced dead about an hour later.

Ramirez was the father of a 1-year-old and his wife is 3 months pregnant, according to family.

He worked for QSI, a contractor hired to clean the Perdue plant. [Emphasis added]

Perdue is one of the sleaziest operators in a very sleazy business. Yet, this will keep happening until CEOs starting going to jail for long periods of time, convicted of murder or manslaughter. Fines are not enough. To CEOs, fines are just a cost of doing business—and workers’ deaths are no more troublesome than tossing away a used screwdriver.

Stay cool out there. And wear a damn mask.

If you liked this post from Working Life Newsletter, why not share it?